Bainbridge Island’s real estate market finished 2020 with a strong fourth quarter. We’ve compiled key stats below to provide a comprehensive review of our local market, as well as insights and a 2021 market forecast from Windermere Real Estate’s Chief Economist, Matthew Gardner.

Our Strong Seller’s Market

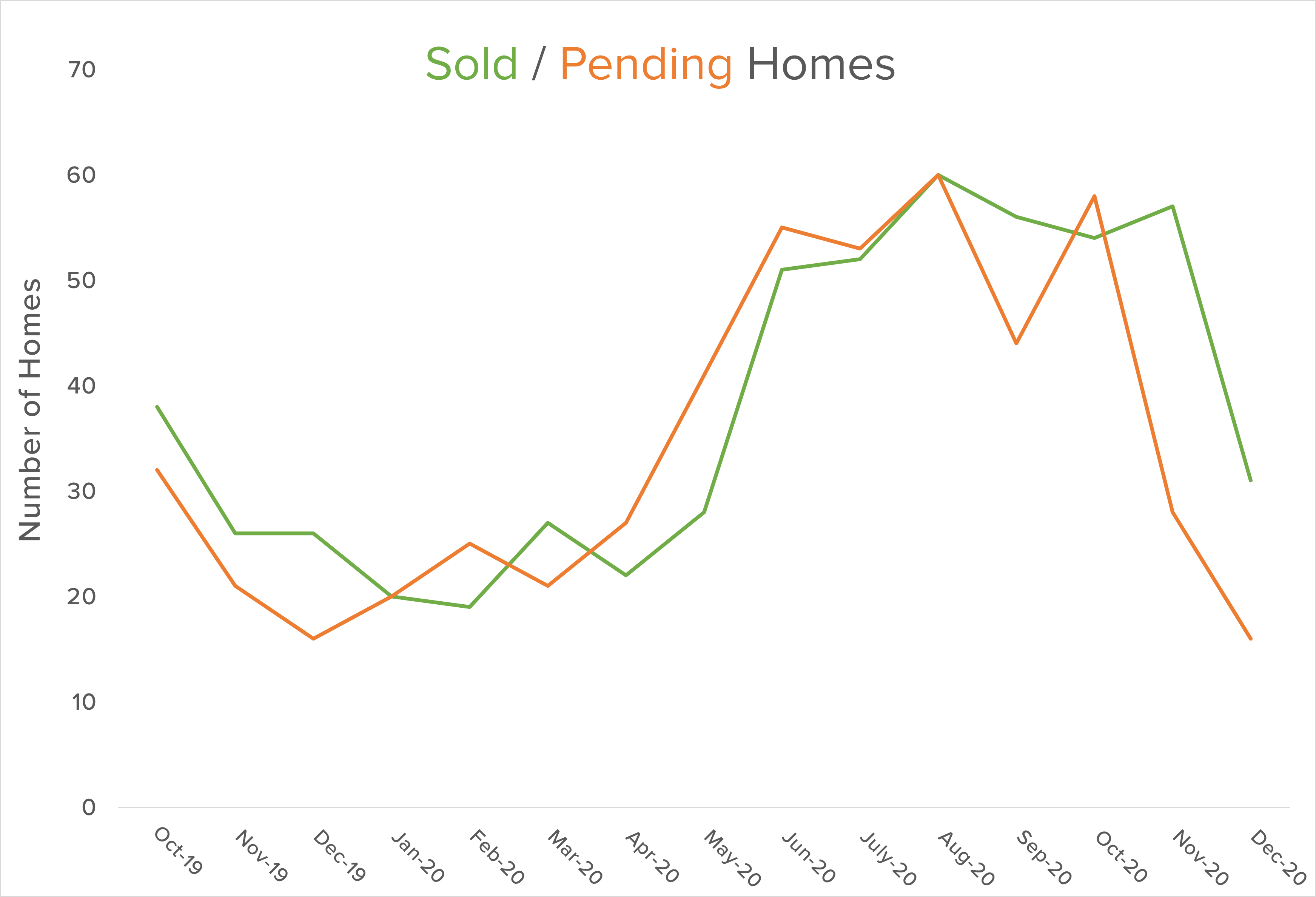

It’s still a strong seller’s market here on Bainbridge Island. Inventory remains low while demand is high. Buyers should be aware that the market is in a seasonal slowdown, but not as slow as expected, given COVID-19. There are still many buyers looking to move away from Seattle, but still remain close by; inventory remains low, giving the advantage to sellers. Our Brokers have seen an increase in situations where some buyers are outbid either by price or an all-cash offer.

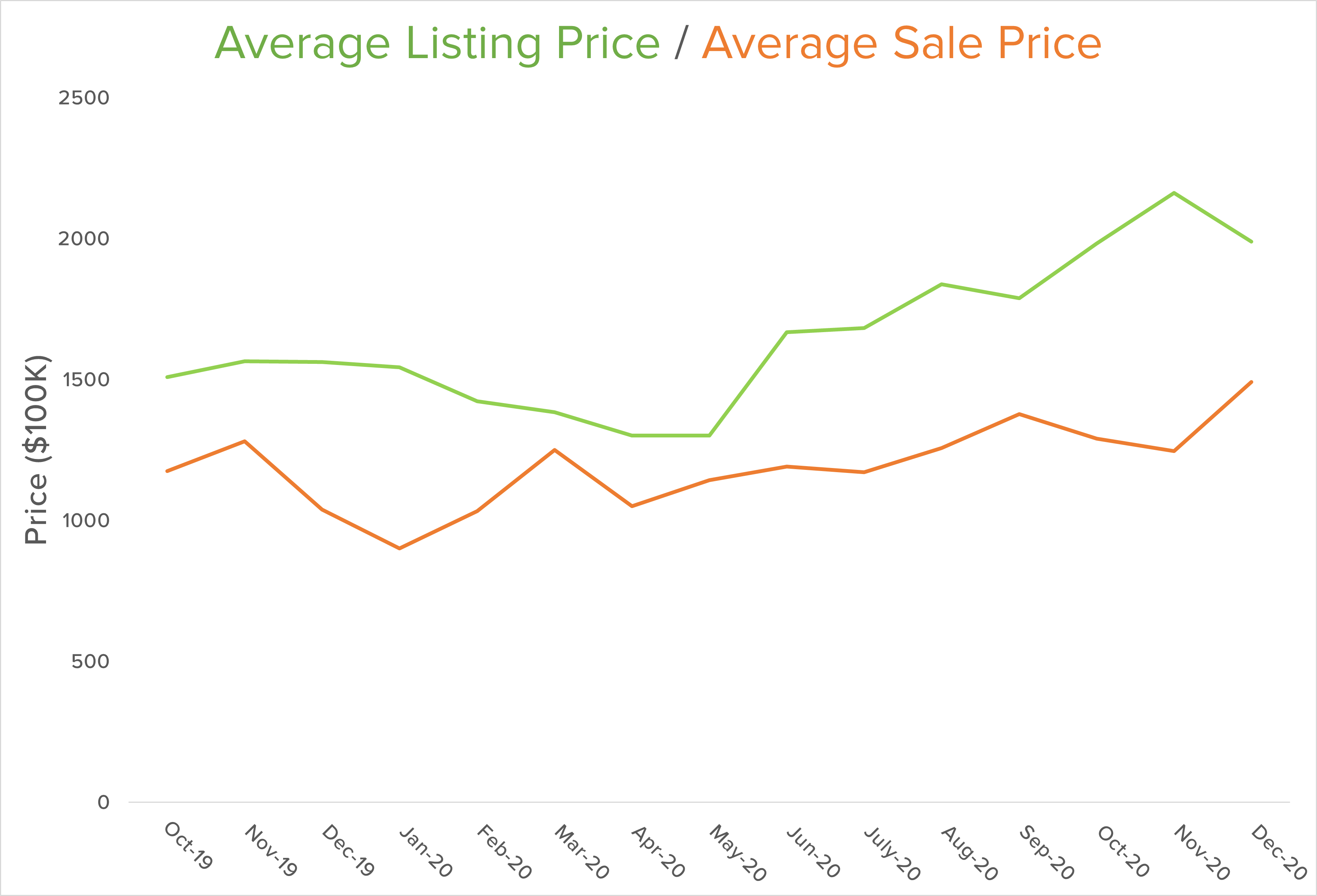

In 2020’s fourth quarter, the average sale price on Bainbridge Island was up 12.9% year-over-year at a very strong $1.315M. Sale prices continue to hover close to listing prices, indicating strong demand.

2021 Market Forecast

In his final Monday with Matthew video of 2020, our Chief Economist, Matthew Gardner, shared his 2021 market forecast. He’s optimistic and for some good reasons.

First off, Gardner expects mortgage rates will not rise significantly on a local level, nor will they vary significantly throughout different regions across the U.S. Since mortgage rates are heavily tied to 10-year treasury maturity rates/yields, rates shouldn’t rise significantly until the entire market recovers from the COVID-19 slowdown. Another great sign is that Gardner expects home sales will grow, from 5.55% in 2020 to 5.93% in 2021. That’s “to a level we haven’t seen since 2006,” Gardner explains. With the continuation of historically low mortgage rates and the consistent increase of home values, 2021 looks bright.

“No! There isn’t a housing bubble forming. But price growth will slow & sellers may feel like it’s a collapse … it isn’t collapsing, it’s just normalizing.”

Matthew reminds us that there are pitfalls to be wary of in this strong market. First and foremost: “we need more inventory.” With the shuffling to new homes, and the huge wave of “first-time buyers [that] will continue to be a major player in the housing market,” many are making moves in a flood that will not persist. Buying during the pandemic will slowly settle. People are expected to stay in their homes longer, especially homeowners who have chosen to refinance. House values will rise due to the lack of supply, and that may price out many buyers who want to purchase in our area.

Western Washington’s Market Report

WESTERN WASHINGTON HOME SALES

- Total Sales: 26.6% increase from Q4/2019, but 8.3% lower than Q3/2020

- Homes for Sale: 37.3% lower than Q4/2019, and 31.2% lower than Q3/2020

- Pending Sales: up 25% from Q4/2019, but 31% lower than Q3/2020

- Average: $617,475 (up 17.4% from Q4/2019). This continues the trend of above-average appreciation of home values.

- Interestingly, prices between Q3 and Q4 of 2020 only rose by 1%. Is there a price ceiling we’re reaching?

- Mortgage rates will stay competitive as the market continues to charge toward a price ceiling and potential affordability issues.

- Average: 31 Days (16 days less than Q4 just one year ago)

- In Kitsap County, average days on market: 17

Conclusion

2021 will continue the trend of working from home, which keeps demand high. This, in turn, will drive sales growth, while affordability barriers will balance our current runaway appreciation for home values.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link