The Benefits and Risks of Refinancing a Home Loan Right Now

Refinancing a home loan can be confusing, especially with fluctuating interest rates. A true refinance replaces the current mortgage, and with over 50% of homeowners carrying an interest rate below 4%, it’s important to evaluate if refinancing is a smart move for you.

Reasons to Consider Refinancing

Here are five reasons you might be thinking of refinancing.

- Lower Interest Rate: Reducing your interest rate can lower monthly payments and save money over the loan’s life.

- Shortened Loan Term: Paying off your mortgage faster can save on interest.

- Switch to Fixed Rate: Moving from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage provides payment stability.

- Cash-Out Refinance: Access home equity for home improvements, debt consolidation, or other financial needs.

- Remove Mortgage Insurance: Eliminate PMI from your payment if your home has gained enough equity.

While every homeowner has a different financial situation, looking at example scenarios can help you zoom out to examine the bigger financial picture. Let’s say you have $20,000 in credit card debt with an average interest rate of 18%. Your monthly payments are high, and you’re struggling to pay down the principal. By refinancing your home and taking out $20,000 in equity, you could pay off this debt at a much lower mortgage interest rate, say 4%. This could significantly reduce your monthly payments and save you money in interest over time. However, it’s important to ensure that the new mortgage payment is manageable and the overall financial benefit outweighs the costs of refinancing.

Home Equity and Long-Term Investment

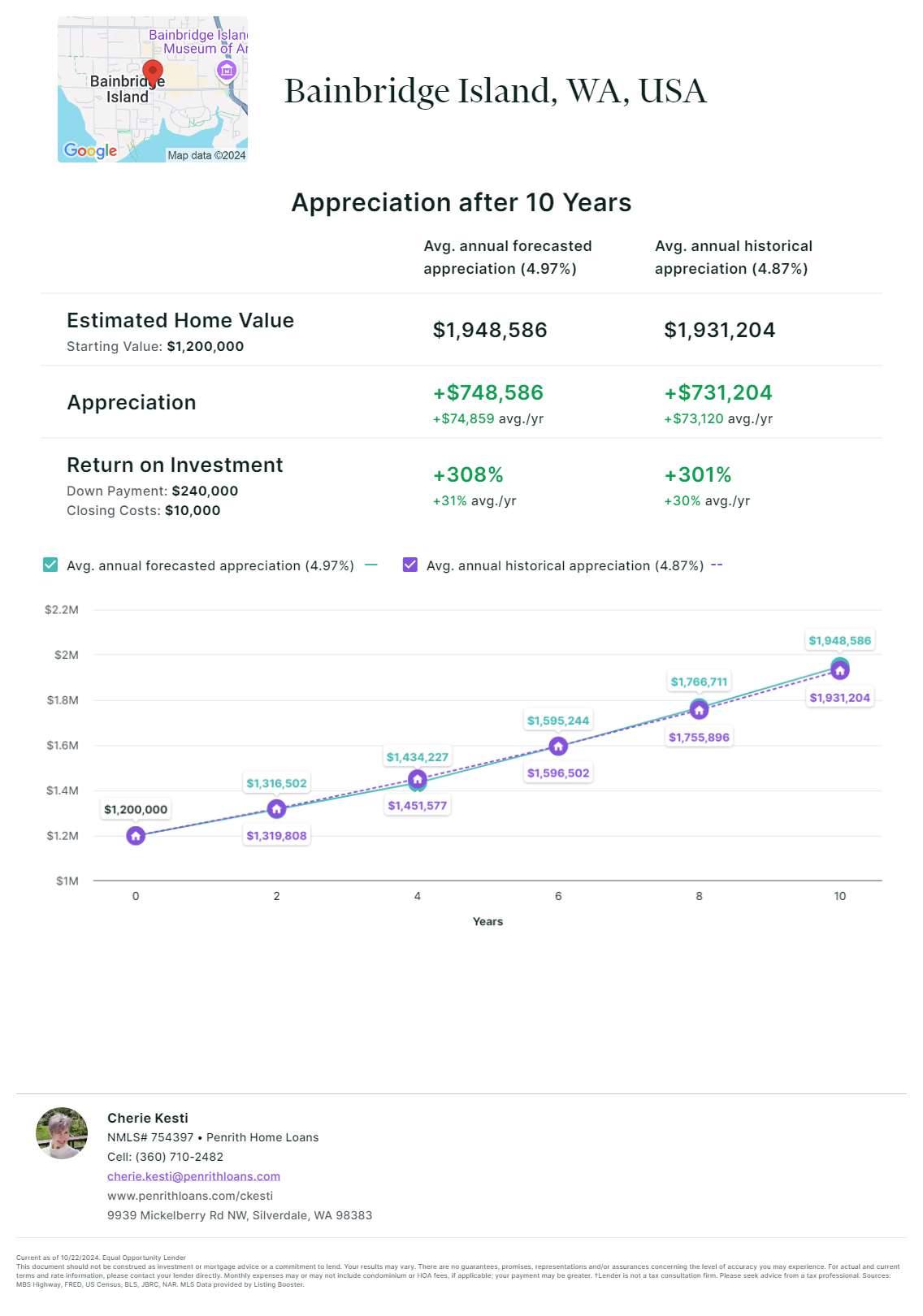

Home Equity builds over time based on national and local housing appreciation trends. A home is a long-term investment. The graphic below shows the 10-year appreciation of a $1.2M Bainbridge Island home. At the end of 10 years, the home has built up about $500K in equity, which can be tapped. The key to refinancing is understanding that some equity must stay in the home, such as 20% for conventional and FHA loans. A VA loan requires that 10% equity stays in the home.

Cost Analysis

When considering refinancing, it’s important to understand the costs involved and how they impact your overall financial picture.

Here are some key costs to consider:

- Closing Costs: These can be up to 2.5% of the loan amount and can include:

-

- Administration Fees: The cost to process the loan.

- Appraisal Fees: Usually between $-0- and $800, this fee covers the cost of assessing your home’s value.

- Escrow and Title Insurance Fees: Protects against any legal issues with the property title.

- Recording Fees: Charged by the local government to update public records.

- Prepayment Penalties: Some existing mortgages have penalties for paying off the loan early. If your current mortgage closed within one year, check with your loan officer.

- Points: You can pay points to permanently lower your interest rate. One point equals 1% of the loan amount.

- Other Fees: These can include credit reports, flood certification, and tax service, which may amount to less than $200.

Consumer Awareness

Understanding and being informed about the refinancing process and its impact on your finances is essential. It helps you make better decisions.

Here are some tips and strategies to discuss with your trusted loan officer:

- Evaluate Your Financial Situation: Ensure refinancing aligns with your long and short-term financial goals, including total payment analysis and future appreciation benefits.

- Understand the Loan Terms: really understand the new loan terms, including the interest rate and monthly payments.

- Consider the Break-Even Point: Calculate how long it will take to recoup the refinancing costs with your monthly savings.

- Consider the Impact on Your Credit: Refinancing can affect your credit score. Multiple credit inquiries can lower your score temporarily, but the long-term benefits of a lower interest rate can outweigh this.

- Plan for the Future: Think about how refinancing fits into your overall financial plan. Will it help you achieve your goals? It may help you pay off debt, fund your child’s education, or make home improvements.

Break-Even Point

To determine if refinancing is worth it, we’ve included an example of a break-even calculation, which is the time it takes for the savings from the lower monthly payments to cover the refinancing costs.

Here’s a simple formula:

If your refinancing costs are $5,000 and you save $200 per month, your break-even point would be: 25 months

If you plan to stay in your home longer than 25 months, refinancing could be beneficial.

Work with a Trusted Local Lender

Here at Windermere Bainbridge Island, we’re proud of our partnership with Penrith Home Loans. Cherie Kesti, a trusted, local Penrith Home Loan Officer, is an excellent resource. In fact, she provided most of this article’s helpful information. Cherie can provide a comprehensive analysis of your refinance options. She will tailor it to your goals, factoring in the current equity in your home. If now isn’t a beneficial time, Cherie can help you understand the equity target and optimal conditions needed to better align with your financial objectives. Simply contact her to get started.

Should You Buy a House or Wait? Market Data & Insights

If you are thinking about buying a home, you may be asking whether you should buy a house now or wait. There are several factors to consider, including your personal situation, the overall market, and being able to find a home that’s right for you. We’ve gathered the most recent market data and insights to help you make an informed decision.

A Look at the U.S. Housing Market

Whether you are wanting to stay in your current community or move out of state, it’s important to look at the U.S. housing market. While there are nuances and fluctuations depending on supply and demand in certain areas, the bigger picture still influences local markets. According to Windermere’s Chief Economist, Matthew Gardner, the number of homes for sale remains close to historic lows. “When adjusted for seasonality, there were just 1.03 million single family and condominium homes for sale in the month of August. That’s down 8.3% from a year ago, and the second lowest level in 2023.”

Gardner explains that this is due to mortgage rates. Current home owners are reluctant to sell and trade their low mortgage rates for a much higher one. This hesitancy is keeping the housing market tight with fewer homes for sale overall. As Gardner points out in the above video, you can’t buy what’s not for sale. However, there will always be people who need to sell due to job changes, downsizing needs, and more.

Western Washington and Bainbridge Island Market Update

When taking a closer look at the housing market in Western Washington, mortgage rates are definitely playing a role regionally as well. In the third quarter of 2023, sales fell even though the average number of homes for sale increased 29.5% from the second quarter. Gardner said he was surprised that “prices rose over the previous quarter despite the fact that mortgage rates were above 7% for almost the entire quarter.” In fact, prices for Kitsap County rose between 4% to 6.9%, which is higher than most other counties in our region. This factor, combined with other market data and insights, leads Gardner to believe that it’s still a seller’s market in Western Washington, but only slightly.

But what does this all mean if you want to buy a home on Bainbridge Island? Some of these trends are carrying over to the Bainbridge Island housing market as well, but with differences in the numbers. In the third quarter of 2023, there were 80 closed sales, which is down 21.6% year over year. However, the average home sale price was $1.6 million, which is up 8.9% year over year. Additionally, sellers received 101% of the list price. So as a buyer, the best thing to do is to assess your finances and see if there are options on Bainbridge Island that fit your criteria and price range.

Individual Considerations

If you are a Bainbridge Island homeowner and need to purchase a house elsewhere, you are in a good position to sell and buy that next home. If you are looking to relocate and move to Bainbridge Island, then it’s important to assess your personal situation and your financial goals. Keep in mind that Gardner expects inventory to remain low through next year. This means that if you see a great home now that meets your needs, you might as well put in an offer. Chances are that inventory won’t significantly increase any time soon. Plus, there will most likely be more buyers to compete with during next spring and summer when the market tends to heat up.

What About Interest Rates?

There is no denying that interest rates are high right now. According to Gardner, interest rates are now at levels not seen since the fall of 2000. But don’t let this discourage you from purchasing a home. Windermere partners with Penrith Home Loans, and Cherie Kesti, a Penrith Branch Manager and Mortgage Consultant, points out, “As we say in real estate, marry the house, date the rate. If you wait to buy, most likely the home’s value will continue to increase. This requires a larger loan regardless of the interest rate. If you buy now with a lower home value, you will have a smaller loan. With refinancing, this means a smaller monthly payment in the future.”

So, don’t let high interest rates stop you from moving forward in life. With such limited housing inventory available, the chances are homes will continue increasing in value the longer you wait. This leads to higher prices in the future, which are much harder to negotiate down in a tight market. It’s much easier to refinance a loan.

Get Advice from an Expert

If you’re still not sure what to do, contact a Windermere Bainbridge Island real estate agent to help you. Our agents are proud locals with extensive market knowledge. They will be able to guide you in the decision making process and tell you about recent home sales.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link