Should You Buy a House or Wait? Market Data & Insights

If you are thinking about buying a home, you may be asking whether you should buy a house now or wait. There are several factors to consider, including your personal situation, the overall market, and being able to find a home that’s right for you. We’ve gathered the most recent market data and insights to help you make an informed decision.

A Look at the U.S. Housing Market

Whether you are wanting to stay in your current community or move out of state, it’s important to look at the U.S. housing market. While there are nuances and fluctuations depending on supply and demand in certain areas, the bigger picture still influences local markets. According to Windermere’s Chief Economist, Matthew Gardner, the number of homes for sale remains close to historic lows. “When adjusted for seasonality, there were just 1.03 million single family and condominium homes for sale in the month of August. That’s down 8.3% from a year ago, and the second lowest level in 2023.”

Gardner explains that this is due to mortgage rates. Current home owners are reluctant to sell and trade their low mortgage rates for a much higher one. This hesitancy is keeping the housing market tight with fewer homes for sale overall. As Gardner points out in the above video, you can’t buy what’s not for sale. However, there will always be people who need to sell due to job changes, downsizing needs, and more.

Western Washington and Bainbridge Island Market Update

When taking a closer look at the housing market in Western Washington, mortgage rates are definitely playing a role regionally as well. In the third quarter of 2023, sales fell even though the average number of homes for sale increased 29.5% from the second quarter. Gardner said he was surprised that “prices rose over the previous quarter despite the fact that mortgage rates were above 7% for almost the entire quarter.” In fact, prices for Kitsap County rose between 4% to 6.9%, which is higher than most other counties in our region. This factor, combined with other market data and insights, leads Gardner to believe that it’s still a seller’s market in Western Washington, but only slightly.

But what does this all mean if you want to buy a home on Bainbridge Island? Some of these trends are carrying over to the Bainbridge Island housing market as well, but with differences in the numbers. In the third quarter of 2023, there were 80 closed sales, which is down 21.6% year over year. However, the average home sale price was $1.6 million, which is up 8.9% year over year. Additionally, sellers received 101% of the list price. So as a buyer, the best thing to do is to assess your finances and see if there are options on Bainbridge Island that fit your criteria and price range.

Individual Considerations

If you are a Bainbridge Island homeowner and need to purchase a house elsewhere, you are in a good position to sell and buy that next home. If you are looking to relocate and move to Bainbridge Island, then it’s important to assess your personal situation and your financial goals. Keep in mind that Gardner expects inventory to remain low through next year. This means that if you see a great home now that meets your needs, you might as well put in an offer. Chances are that inventory won’t significantly increase any time soon. Plus, there will most likely be more buyers to compete with during next spring and summer when the market tends to heat up.

What About Interest Rates?

There is no denying that interest rates are high right now. According to Gardner, interest rates are now at levels not seen since the fall of 2000. But don’t let this discourage you from purchasing a home. Windermere partners with Penrith Home Loans, and Cherie Kesti, a Penrith Branch Manager and Mortgage Consultant, points out, “As we say in real estate, marry the house, date the rate. If you wait to buy, most likely the home’s value will continue to increase. This requires a larger loan regardless of the interest rate. If you buy now with a lower home value, you will have a smaller loan. With refinancing, this means a smaller monthly payment in the future.”

So, don’t let high interest rates stop you from moving forward in life. With such limited housing inventory available, the chances are homes will continue increasing in value the longer you wait. This leads to higher prices in the future, which are much harder to negotiate down in a tight market. It’s much easier to refinance a loan.

Get Advice from an Expert

If you’re still not sure what to do, contact a Windermere Bainbridge Island real estate agent to help you. Our agents are proud locals with extensive market knowledge. They will be able to guide you in the decision making process and tell you about recent home sales.

Selling and Buying a Home at the Same Time – FAQs

Selling a home while buying another home at the same time can be challenging. If you are thinking about doing this, you probably have questions. So, we’ve gathered together a list of frequently asked questions to help you through the decision-making process.

What are the pros and cons of selling a home with a contingent offer?

Cons: If you accept a contingent offer, there’s no guarantee that the buyer’s home will sell quickly. As a result, if you need to sell your home within a certain time frame, it’s essential to specify a timeline in the contingency agreement. This gives you an out if their selling process drags on.

Pros: If your house has been on the market for a while, a contingent offer might be a better option than no offer. But what if another offer comes in while the contingent offer is in place? This can happen. To prepare for this type of scenario, be sure to include a “bump” clause. As part of the contract, include language that specifies a time frame for the first buyer to decide whether they still want to pursue the contract. This requires the buyer to respond. If the buyer does not respond, you can legally back out of the contract and pursue the new offer.

What are the pros and cons of buying a home with a contingent offer?

Cons: A contingent offer doesn’t mean as much in a popular market such as Bainbridge Island. Multiple buyers with multiple offers can be common. As a result, it might be harder to get a seller to agree to a contingency offer. Also, you may be competing with buyers who don’t need to sell their home before buying, making a contingent offer impractical. If you really want to purchase a particular property, you may have to make an offer outright.

Pros: If you are able to place a home sale contingent offer, this allows you to smoothly transition between houses. You won’t have to worry about renting a temporary place or placing your belongings in storage. Once your home is sold, another one will be ready and waiting for you.

If you have more questions about contingency offers, we’ve compiled more detailed information for you.

Do I buy or sell first?

This is a great question because there are pros and cons to both. Even if you intend to do both simultaneously, you will most likely have to begin one before the other.

Selling first: Starting the selling process first sets you up for greater success in buying a new home. If you sell your home, you’ll have more cash available, which increases your buying power and your down payment. It’s also nice to pay off your first mortgage through the sale before taking on a new one. However, the downside to selling first is that you don’t have a new place to move into. This is a common scenario when selling and buying a home since the timing rarely aligns perfectly. If you do find yourself in this position, one option is to negotiate a rent-back agreement with the buyer. This will allow you to rent the house temporarily and give you more time to find your new home.

Buying first: Buying a new home before selling makes moving a lot simpler. There’s no need to find temporary housing. Instead, you can pack up and move everything to the new place. Making the decision to buy first really comes down to your finances. Having two mortgages means taking on more debt, which can impact your loan terms for the new house. Also, if you haven’t sold your home first, it might be challenging to arrange enough money for a down payment. Without a down payment of twenty percent, obtaining private mortgage insurance (PMI) may be necessary. Lastly, the decision to buy first is based on the assumption that your current house will sell relatively quickly. This is a safe assumption in the Bainbridge Island market, but not a guarantee.

Ultimately, the decision to sell or buy first depends on your situation and what works best for you.

Do I really need to stage my house?

The simple answer is yes. While staging your home may seem like a daunting task, it’s worth the effort and investment. Overall, staged homes typically sell faster and for more money – a double win! Also, a big part of the selling process takes place online. This is where most buyers will see your home first. A staged home better lends itself to eye-catching photos and great first impressions. When potential buyers see your home online, you want them to be able to imagine themselves living there. Staging is the best way to do this and helps interested buyers take the next step. Even partially staging your home can be incredibly beneficial.

Is now a good time to buy and sell?

Based on what we’re seeing in the Bainbridge Island market, we think the answer is yes. The average sale price here in Q1 was $1.6M – and that’s the slow season. Bainbridge’s housing market is heating up and a great real estate agent can help you achieve your goals. Here at Windermere Bainbridge Island, our local agents are highly rated, know our market, and can effectively negotiate on your behalf. Contact us today, and we’ll help you get started.

Bainbridge’s Market: First Quarter, 2022

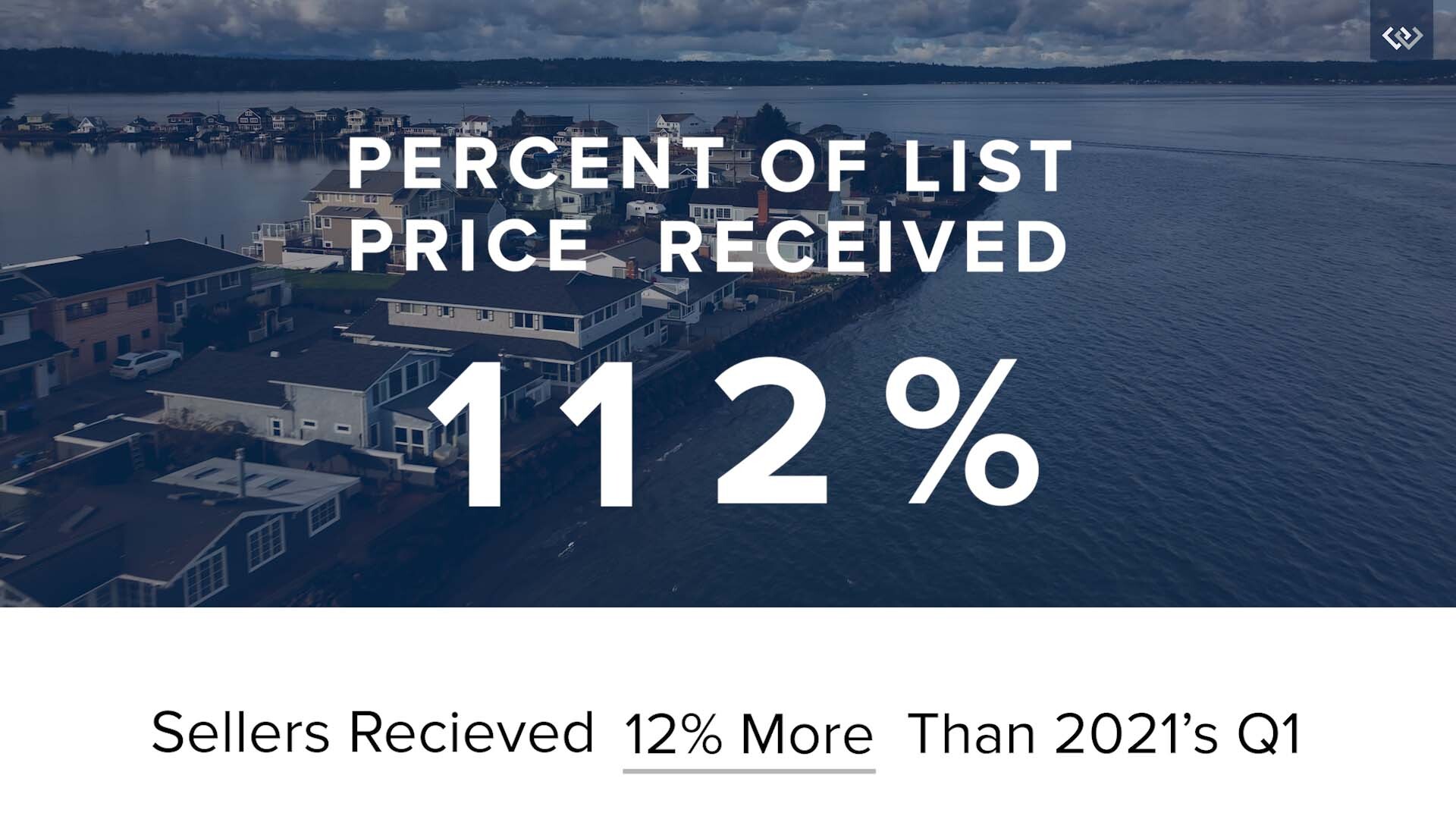

Bainbridge’s market picked up in the first quarter of 2022. As was the case in 2021, it’s a seller’s market due to low inventory and high demand. Homes are still selling above the asking price and we’re seeing multiple offer situations and many all-cash offers. We’ve compiled key highlights from last quarter to keep you in the know about our local market.

Sold and Pending Homes

In the last five quarters outlined in the graph, 2022’s first quarter is rising like the first quarter of 2021. This follows the usual real estate market trend and we expect to see another hot market this summer. There’s also a significant lack of inventory and there are many eager buyers, driving prices up and heavily influencing our seller’s market.

Bainbridge’s Market Still Favors Sellers

Everyone is feeling the fatigue of low supply, which persisted in the first quarter of 2022. But we expect the market to warm up as we head toward our busy summer season. More real estate activity lies ahead, and if you’re thinking of selling, it’s a great time to do so. If you’re looking to buy, be prepared for the competition and know that having a local real estate agent at your side is extremely beneficial.

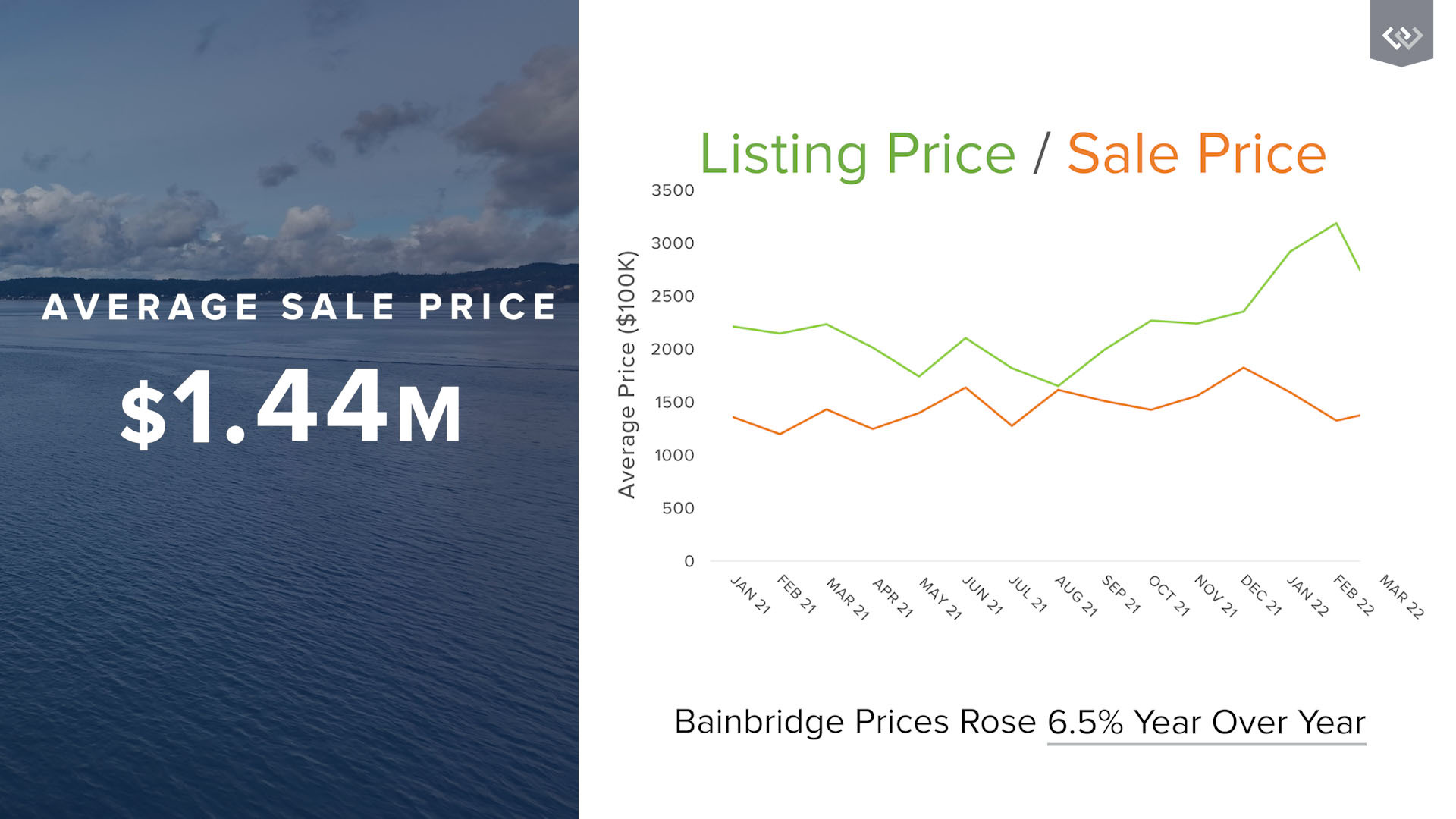

Listing Price vs. Sale Price

As a result of low supply, average prices rose 6.5% when compared to this time last year. They are expected to continue to rise as Bainbridge’s buyers meet the pricing demands of sellers. And, the average sale price on Bainbridge Island is almost $1.5 million.

Insights from Our Chief Economist

Matthew Gardner, Windermere’s Chief Economist, shared his Top 10 Predictions for 2022 in one of his recent Monday with Matthew videos. Here’s what Gardner predicts for 2022:

- Prices will continue to rise, though the pace of appreciation will slow. Gardner thinks it will be about 6% in 2022 versus the massive 16% rise of 2021.

- Spring will be busier than expected. This will increase buyer demand, as buyers get more clarity in their new hybrid model combining remote and office work.

- The rise of the suburbs will also result from this work hybrid model. Many buyers are moving within the same area they already lived in.

- New construction jumps since the cost to build has come down.

- Zoning issues will be addressed.

- Climate change will impact where buyers live. People will focus more on how safe a location is in relation to natural disasters.

- Urban markets will bounce back after the demand drop from Covid.

- A resurgence in foreign investors will return since the travel bans were lifted last November. The demand will rise as long as our borders remain open.

- First-time buyers will be an even bigger factor in 2022. This year, 4.8 million millennials will turn 30, the median age of American first-time buyers. Additionally, first-time buyers will be looking for cheaper markets.

- Forbearance will come to an end and that will be okay. It was well thought out, and as Gardner says, “as of recording this video, there are now fewer than 900,000 owners still in the program.” Hopefully, this continues to drop.

For additional information, check out Matthew Gardener’s Market Update by region.

Fourth Quarter Market Review for Bainbridge Island

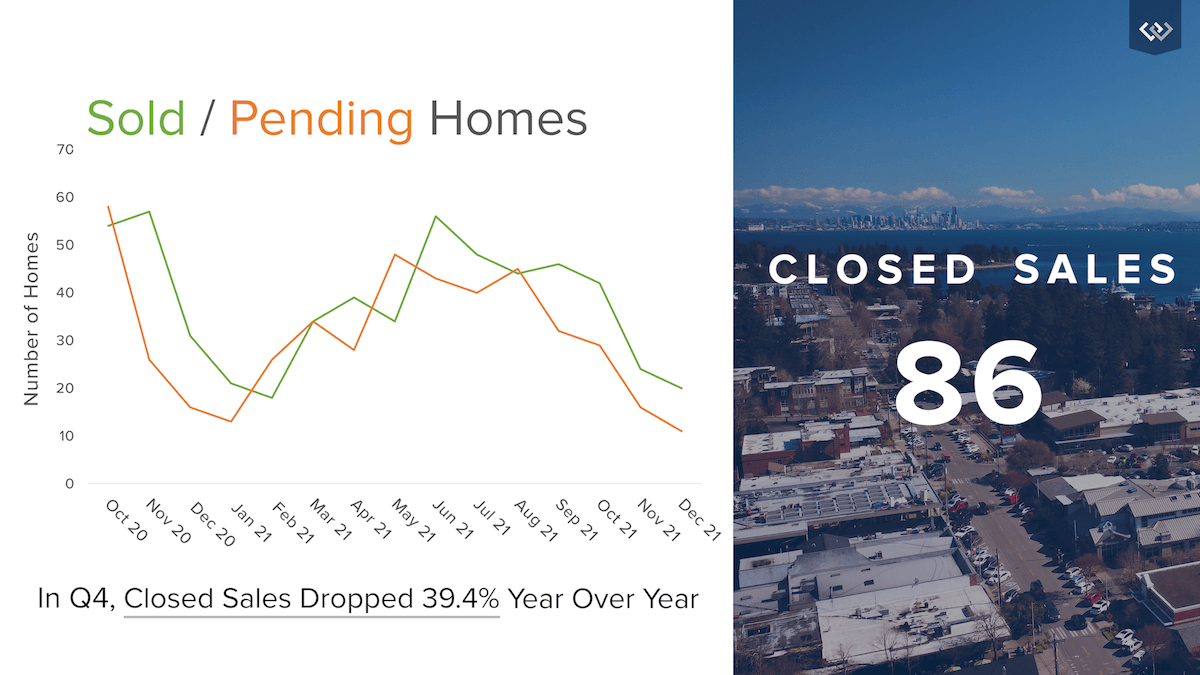

Bainbridge’s real estate market slowed down for the holidays during our fourth quarter. The market still favors sellers due to low inventory, and homes are still selling above the asking price. We’ve compiled key highlights to keep you in the know about our local market.

News on Sold and Pending Homes

In the last five quarters outlined in the graph, 2021’s real estate market started with the usual growth trend into the summer. Now, we’re seeing the seasonal downswing during colder months. However, home prices are still increasing due to demand and sold homes still outpace pending listings. The result is a strong seller’s market. In the 4th quarter of 2021, we had 86 closed sales, which is a 39.4% decrease, year over year.

Still a Strong Seller’s Market

Bainbridge Island real estate demand was at a record high in the fourth quarter of 2021. With the new era of remote work, many Seattle homebuyers are seeking the quaint island feel that Bainbridge offers. If you want to learn more about Bainbridge Island, check out our free digital guide. If you’re interested in buying or selling, our local experts are here to help.

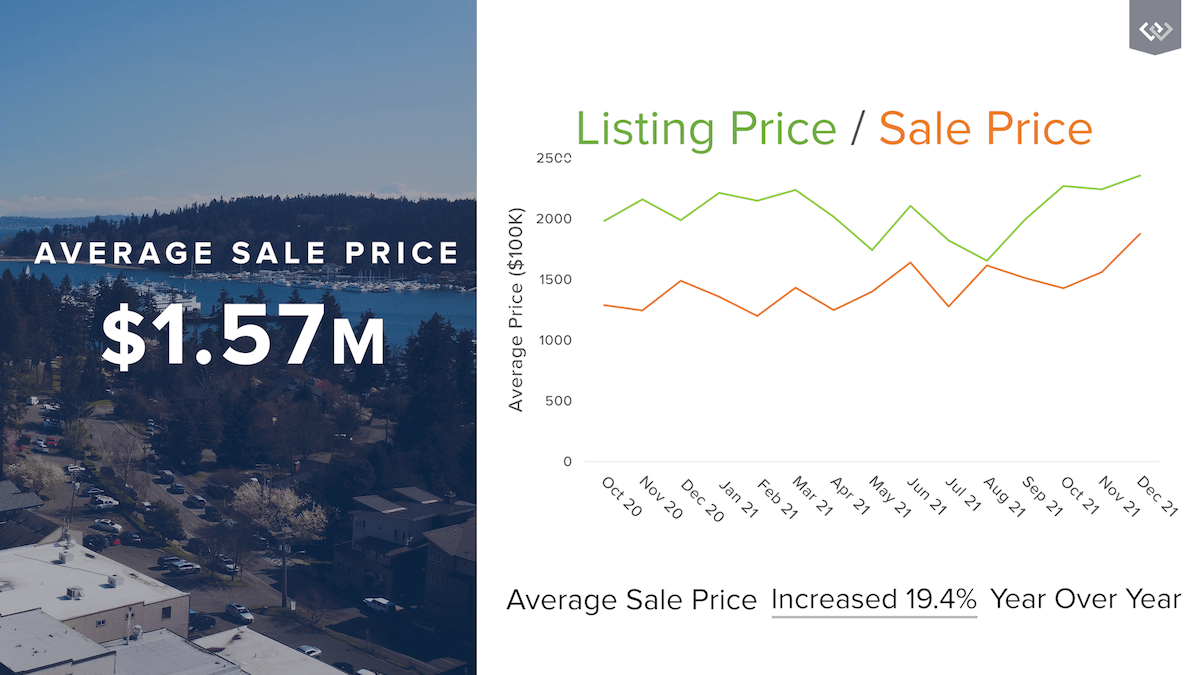

Listing Price vs. Sale Price

Although buyers continue to meet the competitive Bainbridge pricing, there just aren’t enough homes available right now. As you can see in the graph above, the averages of listing and sale prices are starting to converge as demand stretches the cost of housing even further in favor of sellers. In our 4th quarter, we saw a 19.4% increase in the average sale price on Bainbridge Island, putting it at $1.57 million.

Insights from Our Chief Economist

In his most recent Monday with Matthew, Windermere’s Chief Economist, Matthew Gardner, shares his market forecast for the coming year: “If everything goes according to my plan, you should expect to see the housing market start to move towards some sort of balance next year, but I am afraid that it will still remain out of equilibrium until at least 2023.” Gardner reminds us that the transition back to a balanced market will be a gradual shift.

While Matthew ensures us that he “doesn’t see a housing bubble forming,” he goes on to say “it would be silly to say that there aren’t any issues in the housing market that concern me because there are and the biggest of which is housing affordability.” There is definite cause for concern among the millennial generation as they start “thinking about settling down and, possibly, having children” Gardner explains. “I wonder how hard it will be for many of them to be able to afford to buy their first home.” Millennials are currently the largest slice of the generational real estate market, so it will be interesting to see where affordability and demand intersect.

Overall, Gardner concludes with a high-level market analysis: “demand for ownership housing remains remarkably buoyant and, in fact, it is quite likely that demand may actually increase with the work from home paradigm that will start to gain momentum next year.” With dependable demand, real estate continues to be an excellent investment.

Selling in Winter: 4 Reasons Why It’s a Good Time to Sell

Selling in winter may not seem optimal but there are actually some important advantages to consider, especially given our current market. Here are four reasons why now may be the right time for you to sell.

1. Demand is High and Supply is Low

There are many anxious buyers who want to move to our area. Western Washington has seen a significant increase in demand. Here on Bainbridge Island, closed sales were up 43.6% year-over-year in 2020’s third quarter. Multiple offer situations have become common and our agents have seen quite an increase in all-cash offers. Additionally, many families are able to work remotely and they’re drawn to all Bainbridge Island offers.

2. Mortgage Rates Have Hit Historic Lows

During 2020, mortgage rates hit all-time lows a dozen times. As of December 3, 2020, rates on a 30-year and 15-year fixed-rate mortgage (FRM) have dropped to 2.7% and 2.3%, respectively. These low-interest rates incentivize serious buyers and create a sense of urgency for many.

3. Home Prices Are Up

Since inventory is low, prices have gone up. In fact, the median sale price was 1049K in 2020’s third quarter, which was up 19.9% year-over-year. So you could potentially sell your house for top dollar. If you’ve properly prepared your home and your agent is marketing it effectively, you could also experience a multiple offer situation.

4. Many Buyers’ Priorities Have Shifted

With the pandemic, many buyers are focusing more on finding homes that offer space: a backyard, proximity to nature, and room for their children to play and/or a home office. Bainbridge offers all of that as well as gorgeous beaches and hiking trails, a strong sense of community and easy access to the city. This appeals to first-time buyers as well as those looking for luxury homes. So even though it’s not the popular time to put your home on the market, it’s still a strong seller’s market and there are still plenty of serious buyers ready to make an offer on the right property.

Everything You Need to Know about Title Insurance

Title insurance is a policy that protects you from potential problems when acquiring real estate. When you buy real estate, you’re also buying all of the assets and liabilities associated with that property. So title insurance protects you from any past title problems. Some of these problems can include forgery, fraud, liens, and prior mistakes in legal documents.

Types Of Title Insurance

There are two main types of title insurance: lender’s title insurance and owner’s title insurance. Most lenders require the borrower (homebuyer) to purchase a lender’s title insurance policy, which protects the lender. It is important to note that a lender’s policy will not cover the homebuyer from any problems with the title. To protect yourself, consider purchasing owner’s title insurance.

Owner’s title insurance will protect you, the homebuyer, from any aforementioned issues. A title search examines public records and legal documents to confirm the legal ownership of a property before a transaction takes place. It is usually performed by an attorney or a title company. Although this procedure will often identify any title issues or mistakes, sometimes mishaps occur. These mistakes can be costly down the road, so buyers often purchase title insurance to protect them and their mortgage lender from financial loss if there’s a problem with the title after the sale.

Common Claims

Some common claims filed against a title are back taxes and liens. Liens are a right to keep possession of property belonging to another person until a person’s debt is cleared. It is rare for title companies to miss a lien, but if that does happen, it can cause quite a legal headache for the homeowner. Title insurance can protect from any issues that arise due to uncleared liens.

A typical title insurance policy covers the following hazards:

- Ownership by a party other than the one who sold it to you

- Incorrect signatures on documents as well as forgery or fraud

- Mistakes in legal papers and inheritance

This type of policy also ensures that there aren’t any outstanding liens for the property. Unlike traditional insurance policies that protect you from future events, title insurance protects you from past events that may not have come up during the purchase of the property.

Title Insurance in Washington State

In Washington state, the owner’s title insurance policy is usually optional and not required by law. You can choose to buy a policy that will cover the full price that you paid for the property. The Office of the Insurance Commissioner has more information about the process of purchasing title insurance in Washington state.

It is important to note that the only time it is possible to secure the owner’s title insurance is at closing. You will not be able to purchase a policy if you discover an ownership issue after you’ve bought the property and ownership has been transferred to you.

Bottom Line

Having title insurance protects both the buyer and seller from potential risks that can lead to a considerable amount of stress down the road. It’s important to talk to your real estate agent about these details. They should be able to guide you through the process and provide additional insight. Our local Windermere agents are also here to answer any questions you may have.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link