New & Relocated Businesses to Check out on Bainbridge

If you get the feeling that new businesses are always popping up on Bainbridge Island, you’re not wrong. Over the last few months, some businesses have moved to new locations, and others have been reimagined. Also, we’re excited about the businesses opening soon. We love to support local shops and restaurants, so of course, we’re excited to share these updates.

Rockin’ Ruby’s Records

Rockin’ Ruby’s has been in Winslow for almost a year, but recently moved locations. Now it’s right next to Bainbridge Apothecary and Tea. You can sip on a Pegasus coffee beverage or Italian soda while you peruse records for sale. This new space will continue to expand its offerings, eventually including beer and wine. Check their website or follow them on Instagram for special events, listening parties, and live music.

Hours: Saturdays & Sundays, 11:00 AM – 6:00 PM | Mondays, Thursdays, Fridays, 12:00 – 6:00 PM | Closed Tuesdays & Wednesdays

New Location: 440 Winslow Way E. Bainbridge Island

Kingfisher

A new addition to the Hitchcock Restaurant Group, Kingfisher is part supper club, part raw bar. After closing Seabird in the fall of 2025, this new concept was born. Self-described as “a multi-use space that operates as a boutique market, a cozy restaurant and wine bar, and the home of our most ambitious culinary dreams.” This is a place that you will want to visit for happy hour or a special evening out. The current iteration of the Sunday evening supper club is Parisian-inspired.

Hours: Wednesdays – Saturdays, 4:00 PM – 8:00 PM | Happy Hour 4:00 PM – 5:00 PM | Supperclub (Select) Sundays

Location: 133 Winslow Way E. Suite 100, Bainbridge Island

2 Businesses That Teamed Up: Dana’s & Wilder Grace

These two Bainbridge Island favorites recently teamed up and moved into a new space. You can now find fashion, gifts, and home goods under one roof, in the Winslow Grove building. Dana’s has been on Bainbridge since 1977, selling gifts and PNW souvenirs and highlighting local vendors. Wilder Grace is known for their seasonal fashion and artisan goods. We love the funny ferry cards by local artist Jen Colburn.

Hours: Mondays – Sundays, 10:00 AM – 6:00 PM

New Location: 400 Winslow Way E, Suite 102, Bainbridge Island

Bainbridge Play Cafe

Coming in April, the Bainbridge Play Cafe is a Scandinavian-inspired play and gathering space. Their website says the space will feature “social gatherings for moms, morning groups for dads, classes for kids, courses for new parents, free weekly storytimes, and everything in between.” We can’t wait to see the space when they open. Owner Amanda Aude was in the 2025 Matchstick Lab Micro Business Accelerator program, which helped bring the concept to life. Follow their Instagram to stay up to date on their grand opening.

Hours: TBA

Location: 360 Tormey Ln. NE Suite 194, Bainbridge Island

Looking for more local inspiration? Make sure to follow Windermere Sound Living, or check out our free Guide to Bainbridge and our Events Guide.

Does Staging Really Help Sell Your Home? Here’s the Data

When it comes to selling your home, first impressions mean a great deal. As you prepare your home for market, you may wonder whether staging your home is really worth the cost. Here are some data-driven insights, best practices, trends, and advantageous approaches to the home-selling process.

Why Home Staging Matters

Staged homes tend to sell faster and often for more money than those that aren’t staged.

Here are some key home staging benefits:

-

Increased buyer engagement online and in person.

-

Higher perceived value and stronger offers.

-

Reduced time on the market since staged listings can motivate buyers to make decisions more quickly.

Home Staging Statistics You Should Know

Recent home staging statistics show clear results:

-

Nearly 50% of sellers’ agents report staging reduces the time on market.

-

83% of home buyers’ real estate agents said “staging a home made it easier for a buyer to envision the property as their future home.”

- The most commonly staged rooms by home sellers’ real estate agents were the living room (91%), primary bedroom (83%), dining room (69%), and the kitchen (68%).

Staging is a strategic part of marketing your home. It can influence buyer behavior. Important rooms in the home are carefully prepared so that they create a strong first impression with buyers, both online and in person.

Best Home Staging Practices

While staging can seem overwhelming, a few smart moves go a long way.

1. Declutter and Depersonalize

While you may have already prepared to deep-clean your home to get it ready for market, it’s crucial to declutter and depersonalize it as well. You want buyers to be able to easily imagine living there. Packing your mementos away, donating unwanted or rarely used items, and getting organized in advance can streamline the preparation process. Minimal décor will help emphasize each room’s size and potential. It’s also a good idea to pare down furniture. You want every area to feel as spacious as possible. If you’re moving into a smaller home, check out these downsizing tips.

2. Focus on Key Areas

Prioritize the areas that matter most, such as your home’s exterior, living areas, kitchen, and primary bedrooms. These impact home buyers’ impressions and can create an emotional connection. Curb appeal can make quite a difference since it’s the first thing buyers see. So, be sure to repaint or pressure-wash your siding, clean your windows, and gutters. Enhancing your property’s landscaping and adding flower pots, outdoor furniture, and/or a fire pit can make it more inviting.

When it comes to the interior, make sure you get rid of any unwanted smells, remove heavy drapery to let as much light in as possible, and consider updating lighting fixtures and hardware to give each space a fresh feel.

3. Use High Quality Photography

The majority of buyers start their home search online. Staged rooms tend to photograph better and attract more online views, showings, and, ultimately, offers. Having an excellent local agent who works with top-tier photographers can make a huge difference. 3D virtual tours and videography, including aerial footage, can also be highly advantageous for your property, especially if the home is well-prepared and staged.

Real Estate Staging Trends

Staging has evolved alongside interior design and real estate trends. Buyers increasingly want a home that supports work, wellness, and entertainment. Think bright home offices, spa-like bathrooms, spacious living rooms, and welcoming outdoor dining areas. With this in mind, staging often includes carefully selected pieces that feel aspirational without being too specific. You don’t want to alienate buyers or have them focus on the decor more than the home itself. Additionally, high-quality virtual tours are becoming the standard, so the more obvious each room’s best qualities are at first glance, the better.

Staging a Waterfront Home

Waterfront homes have their own staging considerations. These properties often offer stunning views, lots of natural light, and potential for outdoor living. With those features in mind, furniture should be arranged to emphasize windows and water views. Patios, porches, decks, and docks should be presented as extensions of the living space. You’ll also want to make sure that your outdoor furniture suggests relaxation and hints at the lifestyle provided with this home. While you may have many elements that create fun themed decor, it’s best to take a minimalist approach. You want to enhance the openness of the waterfront property by focusing on subtle accents such as soft linens, textured natural fibers, sheer curtains, and light colors.

Financial Assistance to Maximize Your Home’s Appeal

Staging is an upfront investment, but not all sellers can or want to shoulder that cost. That’s where the Windermere Ready program comes in. It offers up to $100,000 in financial assistance to make strategic improvements that boost buyer interest and potentially help you sell for more. Learn more about this advantageous program or talk to your Windermere Bainbridge Island Broker to get started.

Cozy Up with These Local Home Goods

Purchasing unique home goods can enhance your home and make it feel more inviting. Since it’s cozy season here in the Pacific Northwest, we’ve compiled a list of some wonderful items you can find right here on Bainbridge Island.

Home Goods That Add Warmth

One way to make a room feel more welcoming in colder months is to give it a soft glow. We love these rechargeable lamps from Conservatory Coastal Home. A seaside-inspired lifestyle store, Conservatory Coastal Home, offers a selection of charming items that provide comfort (see the photo below).

Another way to add warmth is to purchase a rug that softens a space and either ties a room’s color scheme together or provides a pop of color. Check out high-quality rugs like these. You’ll find them at Furnish Bainbridge, which carries home goods and beautifully distinct furniture.

Nothing says warm and cozy like candles. Plum has an excellent selection, and you’ll also find interesting cookbooks with delicious recipes that are perfect on a cold night. While you’re there, you may also want to pick up one of their cute scarves or a new jacket.

Items that Provide Comfort and Enjoyment

Looking for handmade home goods? Pleasant Beach Living has handmade local artist pillows. Get a couple for your living room or bedroom to add a touch of character while making the room more comfortable. Pleasant Beach Living also sells vibrant baskets to help you organize blankets, magazines, or your children’s toys. By doing so, you can enjoy your home even more. Even the coziest room can’t be fully appreciated if there’s clutter.

Another way to help you relax and enjoy time warming up at home is to pick up teas from Bainbridge Apothecary and Tea Shop. This local spot offers over 50 bulk teas, including traditional and wellness varieties. And, they have an online shop.

Useful and Cozy Touches

Household items that are both useful and cozy are a must this time of year. Treat your furry family member to a new place to curl up. We love this all-in-one dog & cat bed from Z Bones. And, this plaid dog blanket will warm up your canine or protect your furniture. For more pet-related ideas, see our article on pet-friendly home decor.

An often overlooked item when updating your home is window coverings. Eagle Harbor Window Coverings offers fabric shades like these that insulate well, filter light, and create a soft look. Automated shades are another option that pairs comfort with convenience.

If you’re crafty or want to take up a new hobby, consider creating something that’s truly one-of-a-kind to add to your bedroom or living room. Esther’s Fabrics on Bainbridge Island is a sewing and crafting supply store that offers a multitude of fabrics and classes. You could create the perfect cozy quilt or pillow, while learning something new.

Hopefully, this list has sparked some ideas to help you elevate your home’s decor. We love supporting local businesses, and Bainbridge Island has many beautiful shops to enjoy. By purchasing one or more of these items, you’ll give a room in your home that special touch, and you’ll support local businesses. Happy shopping!

Our Favorite Local Winter Traditions & Events

Beyond the bustle of official holidays, winter is a time to embrace the stillness and the inherent beauty of the cold. We chatted with our brokers about what they look forward to most during this time of year. From getting cozy to polar plunging, here are some of our favorite winter traditions, plus some upcoming events you will want to add to your calendar.

Getting Cozy on Bainbridge Island

Sometimes, favorite winter traditions are about taking time to savor the season. Sarah Sydor, Managing Broker, shared her family’s fun literary tradition. They like to visit Eagle Harbor Books and each person gets to choose a few books, “to read while we are home together during the cozy winter season. We also get a winter-themed puzzle every year at Eagle Harbor Books or Dana’s.”

Sometimes, you can find great joy just outside your door. Managing Broker Susan Grosten shared, “I love to go to Blackbird Bakery for hot chocolate and their amazing morning glory muffins! It can be crowded, but if the sun is out you can sit at the tables in the closed-off road next door and enjoy people walking by with their dogs. Sometimes there are people playing music out front; it’s charming. The problem is that it is right across the street from my Windermere office, and it is very tempting.” We agree, there are SO many amazing eateries and shops right outside our Windermere Bainbridge office, which is right downtown. And, we love supporting local businesses.

Unique Ways to Celebrate the New Year

Resolutions and champagne toasts are typical new year traditions, but we love to learn about traditions that are as unique as our agents.

Broker Andrea Mann’s family celebrates a Greek tradition, gathering on New Year’s Day to cut St. Basil’s bread. “It is a sweet round bread that has a foil-covered coin baked into it. We cut the bread into triangular slices. Whomever receives the coin is said to have good luck for the upcoming new year!” she explained. Baking the bread is another tradition for her family. Here is a recipe we found for the bread, also known as Vasilopita. It is an egg-bread that is flavored with orange zest and sesame seeds.

Broker Pauline Simon is a third-generation Bainbridge Islander and has a favorite local tradition for starting the new year. “One of my favorite winter traditions is the annual Crystal Springs neighborhood polar bear plunge on New Year’s Day. We all join at the water’s edge, and as soon as we hear the blow of the horn, we run into the water together. Afterwards, we gather around the fire with huge grins on our faces and feel more alive than ever!”

If you are looking to join a plunge this year, you can find more information here. If cold plunging followed by a sauna session sounds appealing, there’s a new business near Lynwood Center called Fire + Floe, which offers contrast therapy: a dip in Puget Sound followed by a cedar sauna session.

Winter Adventures off the Island

If you are looking for inspiration or a reminder to visit a place you haven’t been to in a while, we have a couple of great options from local experts. Vesna Somers, Managing Broker, definitely takes advantage of how easy it is to enjoy Seattle by hopping aboard the ferry. “I love to visit Pike Place Market… strolling the market during the day and hanging out at The Pink Door there for cocktails and dinner at night, ” she shared. The Pink Door has been a staple of Post Alley since the 1980s and is known for their eclectic entertainment and Italian-inspired dishes with local ingredients. Fun fact: the majority of the produce used at the Pink Door is sourced from Butler Farms right here on Bainbridge Island.

Want to get outdoors to enjoy the snow? Owner and Designated Broker Carter Dotson loves to check snow conditions on PowderPoobah before hitting the slopes. If you have a skier or snowboarder in your house, you’ll want to subscribe to their newsletter to stay in the know about where to find the best conditions all season. If you need a warmer jacket or wool socks, we suggest visiting Wildernest on Winslow Way. You’ll find an amazing selection of outdoor apparel.

Upcoming Events

Bainbridge Island is also home to events that will appeal to a wide range of interests. Mochi Tsuki is a Bainbridge Island New Year’s tradition for 36 years and counting. We love this festival, and it will be on January 10th this year. It features performances by Seattle Kokon Taiko, food vendors, and the signature mochi-making.

In February, mark your calendar for Happily Ever After. This is a special event hosted by the BARN Writers’ Studio on February 7th. It combines storytelling with wine and chocolate to celebrate the romance genre. It’s a unique way to celebrate love and literature. If you haven’t visited BARN (Bainbridge Artisan Resource Network) before, we highly recommend it.

Bainbridge Symphony Orchestra’s “All Aboard” will be the weekend of February 13th – 15th. It features Dvořák’s Symphony No. 8 in G Major and is described as “the perfect musical escape to shake off the winter blues and explore the world through sound.” There’s nothing like hearing a live orchestra, and we’re so glad this event is right here on Bainbridge Island.

Lastly, you can’t forget about the dynamic landscape that we call home. Commercial Managing Broker Kelly Muldrow is a big fan of the annual Chilly Hilly cycling event. This aptly named tradition also occurs in February on Bainbridge Island. “It is a great way to connect with a lot of locals, and a lot of people from the cycling community,” he said. Actually, he credits this race as the catalyst for falling in love with Bainbridge. The annual ride is considered the start of the cycling season.

Recurring Winter Events

If you’re looking for an ongoing event or something not too big, there are lots of options for fun on the island this winter. The Marketplace at Pleasant Beach Village has weekly knitting circles and live music most Saturdays. At the Treehouse Cafe, you’ll find trivia nights as well as live music nights. View their events calendar for details. Additionally, Bainbridge Island Museum of Art (BIMA) offers a variety of winter events, including film screenings, artist meet-and-greets, and an MLK celebration. Check out their calendar to learn more.

We hope you are inspired by some of these traditions, events, and activities. May your winter season be cozy, creative, and full of memorable experiences.

Start the New Year Off Right With These Fun Activities

Each new year brings hope and the chance to start fresh. Here are some activities to help you feel rejuvenated and more connected to this incredible place we call home.

New Year, New View

We all get caught up in our daily lives and sometimes we take this gorgeous area for granted. Grab your coat and visit a trail you haven’t been to in months or ever. There are many great trails here on Bainbridge, like Grand Forest, which covers 240 acres and has approximately eight miles of trails. The Kitsap Peninsula offers many wonderful places to enjoy. Another peaceful spot is Point No Point Park and Lighthouse in Hansville. There’s a short nature trail, a beautiful beach, and the oldest lighthouse on Puget Sound. While you’re taking it all in, try to remember what it felt like to experience this place for the first time. Or, if you grew up here, remember the joy of sharing this place with a visitor. Tapping into that can help you see your surroundings with fresh eyes.

Unplug For One Day

If your routine involves a lot of time in front of a computer or on your phone, take a day to fully unplug. Turn off all of your electronics. Yes, even your phone. It can be challenging yet rewarding. Play a board game with your family, write good ol’ fashioned letters or thank you cards, bake cookies for a neighbor. You may be surprised how often you automatically reach for your phone. In just one day, you can see where you really are on the usage spectrum. And, you may decide you want to limit your screen time as a new year’s resolution. Even if you are fine with how much time you spend in front of screens, a day off from electronics can help you appreciate them more.

Share Your Love of Books, New and Old

Whether you’re a voracious reader or have fond childhood memories of reading some of the classics, start the new year off by sharing your love of books. Donate a few of your books to your nearest Little Free Library so that others can enjoy them. If there isn’t a Little Free Library near you, start your own! Either way, it’s a great way to connect with neighbors, friends, and family over beloved books.

After you add to or start your own Little Free Library, you’ll have the perfect excuse to visit your local bookstore. After all, you’ll have gaps on your bookshelf that you’ll need to fill. You can find an array of excellent books at Eagle Harbor Book Co. here on Bainbridge Island and Poulsbo’s Liberty Bay Books.

If you never seem to have the time to sit down with a good book, try downloading a free app called Libby. You can borrow audiobooks by connecting the app to your Kitsap Regional Library card. It’s user-friendly and offers tons of bestsellers and classics for free.

Create a Gratitude Jar

Want a simple yet meaningful activity that gets the whole family involved? Get a large jar and decorate it with the word “gratitude” on it or purchase a gratitude jar like this one. Every week, your family members can put little notes in it, describing what you’re thankful for and memorable moments. To establish this new habit, pick a day that you’ll each add one note to the jar, like on Sundays after dinner. That way, it quickly becomes part of your routine. Also, make sure your gratitude jar is in a prominent place so anyone can jot down a note whenever they want. At the end of the year, you’ll get to go through all of these little notes together. It’s an easy way to regularly practice gratitude and an enjoyable way to reflect on the year’s highlights.

We wish you a happy, healthy 2026!

Why Overpricing Your Home Can Cost You

If you’re preparing to sell, you may run the risk of overpricing your home. From Zestimates to pricing it based on what your neighbor’s home sold for, it can be tempting to price your property based on what you might make. Here are some common challenges sellers face if they overprice their home.

You can lose potential buyers

Overpricing your home may mean potential buyers will not see your listing in their online home search. Most buyers filter their searches by price, and their agent will know the local market. If a buyer’s agent believes a home is overpriced, they won’t want to waste time showing it to their clients, especially when there are properly priced homes ready and waiting. Furthermore, as a seller, you really want to capitalize on the attention your property gets the moment it goes live. Sellers have a small window to capture buyers’ attention, and when it’s new to market, you want to make sure potential buyers see it right away. This translates to more online views, more showings, and more potential offers.

You’ll waste time and resources

Selling your home usually requires a significant amount of prep work. This can include making needed repairs and updates, decluttering and deep cleaning it, staging it, and marketing it. Of course, there are also showings and the need to keep your home meticulously clean if you’re still living in it. If you overprice your home, it could sit on the market for quite a while. Some buyers may see how long it’s been on the market and assume something is wrong with it even if it’s a wonderful property. Overpricing your home could lead to a great deal of time and resources wasted, both for you and your agent. Every week or month that passes without any offers means more staging costs incurred, not to mention still having to pay the mortgage, utilities, landscaping, and more.

There may be appraisal issues

Even if you do find an interested buyer for your overpriced home, if the buyer requires financing, this could lead to appraisal issues. Lenders require an appraisal of the property’s value. If the appraisal comes out below the asking price, the buyer may need to make up the difference. That could cause a buyer to walk away from the deal.

This may lead to lost opportunities

As a seller, you may think that starting high gives you leverage and you can always come down later if needed. However, by doing so, you lose negotiating power as soon as your listing goes live at an inflated price. Most buyers know better, and certainly knowledgeable buyer’s agents will. These savvy folks will wait for the inevitable price drop instead of making a “low-ball” offer. When they do, it’s usually lower than what you would have received if your home had been competitively priced from the beginning. As a result, the leverage shifts from the seller to the buyer. When you finally receive an offer, you’re negotiating from a weakened position with a stale listing. And, they may want to negotiate down even more.

Simply put, overpricing your home can derail the sale from the start. Pay attention to your local real estate market. Don’t ignore the realities of it or the time of year in which you’re selling. It’s best to take a pragmatic approach to pricing and to trust your agent. Our Windermere Bainbridge Island Brokers are highly rated and can provide a free Comparative Market Analysis (CMA). Along with this detailed report on your home’s value, they can discuss our local market here on Bainbridge Island. By beginning with a data-informed approach, you’ll be able to make better decisions. Don’t let your desire to get a little more money by overpricing your home result in a financial loss. Proper pricing gives you the best chance to sell your home quickly, attract motivated buyers, and have a smooth home-selling process.

Enjoy a Wintercation at Bainbridge Senior Living

With winter approaching, many older adults may not be fond of this time of year. Whether you’ve called Bainbridge Island home for decades or you are thinking of moving here, one way to find enjoyment in the chilliest season is by taking a Wintercation at Bainbridge Senior Living. Bainbridge Senior Living, a family-owned senior living community, provides a range of lifestyle options and varying levels of care for seniors. Their Wintercation program is unique and offers many benefits. Learn all about it in our Q&A with Bainbridge Senior Living’s Community Relations Director, Carrie Chavez.

What is Wintercation, and how did it get started?

How much does it cost, and who is eligible?

Is there an application deadline?

What kinds of amenities and activities are included?

- Chef-prepared meals, which are served daily

- Weekly housekeeping and laundry service

- 24-hour staff support and assistance as needed

- Scheduled transportation for errands and appointments

- A full calendar of social, fitness, and creative activities — from art workshops and exercise classes to live music and community events

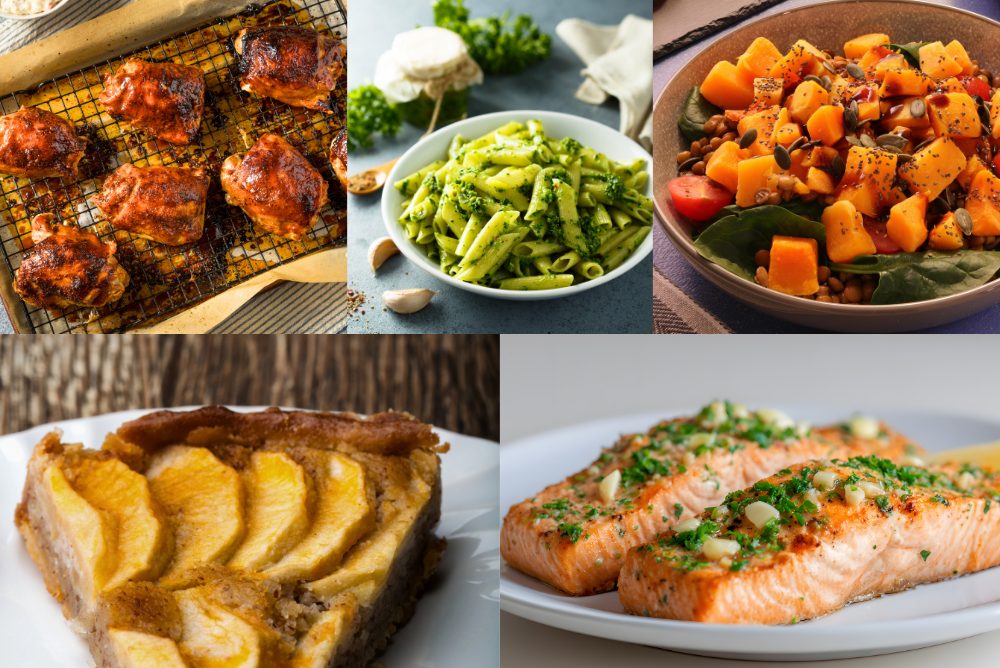

Chef-prepared meal. Photo courtesy of Bainbridge Senior Living.

What have past participants said about Bainbridge Senior Living’s Wintercation program?

Thanks for all of this helpful information, Carrie! Bainbridge Senior Living often has events such as Jeopardy and breakfast socials, and they welcome the community to join in on the fun. Contact them or follow their Facebook page or Instagram to learn more.

If you’re looking for related resources, check out these articles:

Retiring on Bainbridge Island: Amenities and Resources

Downsize with These Helpful Tips

Avoid These Costly Home-Selling Mistakes

Easy Fall Dinners with Local Ingredients

Fall dinners can be easy to make and so flavorful, thanks to local ingredients. We’ve rounded up some delicious recipes that celebrate the season and support Bainbridge Island and North Kitsap businesses and farms. Each recipe is simple enough to make on a weeknight yet unique enough to serve at a dinner party.

Baked Rigatoni with Sausage

Autumn calls for comfort food, and what better way to highlight that than a delicious baked pasta dish? This rigatoni recipe by Giada De Laurentiis, is done in just under an hour. It includes sausage, broccoli, mozzarella and parmesan. (Vegetarians can easily omit the sausage.) Stop into the market at Bay Hay & Feed here on Bainbridge Island to get fresh local produce, meat, and cheese. And, even better, Bay Hay has pasta from Local Goods. Made on Orcas Island, Local Goods’ pastas are made with USDA certified organic Non GMO semolina. For this recipe, you can use their big rigatoni or their beet and kale rigatoni.

Baked Lemon Garlic Salmon

It’s the perfect time to pick up some fresh, wild salmon, and Suquamish Seafoods has that and so much more. An easy weeknight meal, this baked lemon garlic salmon recipe by Suzy Karadsheh of The Mediterranean Dish is packed with flavor and done in about 30 minutes. We recommend pairing it with some fresh bread from Winney Farm and some roasted zucchini or cauliflower – all found at the Bainbridge Island Farmers’ Market.

Roasted Poblano and Corn Soup

As the days get colder, soups become even more enticing! Try this roasted poblano and corn soup recipe from Town & Country Market. By using fresh corn, you’re sure to taste its sweetness, which mixes perfectly with the peppers. This vegetarian meal has just the right amount of heat. In about 50 minutes, you be enjoying the coziness of fall. Best of all, the ingredients can easily be found at Town & Country Market here on Bainbridge Island or at their Poulsbo location.

Cider Glazed Chicken Thighs and Garlicky Green Beans

This recipe for cider glazed chicken thighs only takes about a half an hour. It’s a flavorful, one-pot meal that prove fall dinners don’t have to be tricky or involve tons of dishes. It’s filled with sweet potatoes, apples, and juicy chicken thighs. At the time of writing this, Bainbridge Island/Suyematsu Farms has fresh picked apples that would be perfect in this dish. You could also purchase some of their garlic and green beans to make garlicky green beans for a side dish.

Roasted Winter Squash with Pesto Pasta

Nothing says autumn like bringing something orange to the table. This simple yet scrumptious roasted winter squash recipe makes a great weeknight side dish. It only takes 10 minutes to prep and 30 minutes to cook. Pairing it with a pesto pasta entree creates a colorful meal that will delight your palate. Short on basil or don’t have the time to make pesto from scratch? Stop by Via Rosa 11 here on Bainbridge Island. Their pesto is excellent. It’s made with Genovese basil from Fat Turnip Farms. In fact, Via Rosa has all kinds of great sauces, fresh pastas, soups, and ready made meals.

Fall Dessert Ideas

If you have a sweet tooth, you may be wondering what to make for dessert. Well, Bainbridge History Museum has a great one for you to try. The staff recently shared this historic Apple Torte recipe. It’s from the 1960s and we recommend using crisp local apples for it.

Also, Bainbridge Artisan Resource Network (BARN) has a cooking class coming up on Oct. 12th. It’s called “Use the Whole Pumpkin”. In it, you’ll “learn how to break down a whole local pumpkin and turn it into a from-scratch pie and other meals”. All ingredients are included and it’s taught by Anne Willhoit, a teacher, food writer, photographer, and baker.

We hope these ideas for fall dinners (and more) inspire you to use local ingredients and enjoy what this season offers. And, you may want to visit one of our local wineries to pick up a bottle that will perfectly compliment your meal.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link