Which Bainbridge Island Neighborhood Suits You?

Bainbridge Island’s stunning views and small-town charm attract tourists and buyers alike. It’s also just a quick 35-minute ferry ride away from Seattle. If you are thinking of moving here, it’s best to get an idea of what distinguishes one part of the island from another. Across the island, you’ll find wonderful parks, beaches, hiking trails, and top-tier schools, but there are many different neighborhoods and types of homes. From downtown condos to family-owned farms, wooded retreats to waterfront estates, Bainbridge has an eclectic mix. Here’s an overview of the northern, central, and southern parts of the island.

1. North Bainbridge Island

Above Fay Bainbridge Park. Photo by Leo Phillips.

The Agate Point area is near Agate Pass Bridge, which connects Bainbridge to the rest of the Kitsap Peninsula. There are many homes in the woods and there are others that have water views. It’s also close to the Bloedel Reserve. A 150-acre island gem, the Bloedel Reserve was named one of North America’s Top 10 Botanical Gardens in 2020.

Another notable neighborhood is Port Madison. Homes typically have waterfront views and a New England feel. They’re also conveniently close to the Port Madison Yacht Club, and Fay Bainbridge Park, which has over 1,400 feet of shoreline. This area is also home to the newer Hidden Cove Estates, which has acres of open space and a waterfront park.

If you’re looking for a home with a view of the Olympic Mountains that’s also a waterfront property, consider Manzanita Bay. It has sandy beaches and it is near Meadowmeer Golf & Country Club and 90-acre Battle Point Park.

For a more rural take on island life, Rolling Bay is a quaint community with many homes on acreage. It’s a historic farming area and it’s near the central part of the island. So, you can easily get away from it all yet still be just a ten-minute drive from downtown Winslow.

2. Central Bainbridge Island

Winslow Way and Eagle Harbor. Photo by Leo Phillips.

Central Bainbridge is where to go if you prefer a more urban lifestyle since it’s the economic center of the island, and where the ferry to Seattle is located. Manitou Beach and Murden Cove are perfect places to find a waterfront property with a view of the Seattle skyline.

Wing Point is another popular neighborhood with a variety of homes. Many houses are near Wing Point Golf & Country Club, and some have views of Eagle Harbor.

The cultural center of Bainbridge Island is downtown Winslow. It has interesting boutiques, award-winning restaurants, art galleries, and museums. Thanks to the highly engaged Bainbridge Island Downtown Association, there is never a dull moment. There are many local events including outdoor summer concerts, a great farmers market, and much more. Many properties are within walking distance of Winslow Way, including single-family homes and contemporary condos.

3. South Bainbridge Island

Lynwood Center. Photo by Leo Phillips.

This area has excellent sun exposure and many homes in these neighborhoods have water and/or mountain views. This includes homes in Crystal Springs and Point White. Rockaway Beach and Port Blakely are also popular neighborhoods and there are many low bank waterfront homes there. Additionally, Port Blakely has newer homes built in the early 2000s.

Lynwood Center provides islanders on the south side with their own little downtown, and it’s home to the historic Lynwood Theatre. The surrounding area has grown in recent years with new developments and the renovation of Pleasant Beach Village. You’ll find a variety of shops and restaurants and it is unlike any other area, thanks to its Tudor-style architecture and unique history.

Near the southern tip of the island lies Fort Ward State Park, a 137-acre marine park with over 4,000 feet of shoreline on Rich Passage. The large Fort Ward neighborhood connects to part of Pleasant Beach Drive, which is often referred to as the Gold Coast of Bainbridge since it has many gorgeous, low bank waterfront homes on expansive lots.

After learning more about our island’s neighborhoods, you might be drawn to many of them for different reasons. Can you really go wrong when it comes to living on Bainbridge Island? We don’t think so. Each neighborhood is beautiful in its own way. It’s simply a matter of finding which one fits your wants and needs – and then finding the perfect home to match.

For more information about our area, check out our Newcomer’s Guide to Bainbridge Island. In it, you’ll find videos, articles, and helpful links to learn about our neighborhoods, schools, outdoor activities, housing prices by city, local home buying resources, and much more.

4 Tips for Buying a House in Our Strong Seller’s Market

Many buyers are scrambling to secure their dream homes, especially since we have such a strong seller’s market here on Bainbridge Island. Multiple offer situations have become very common. Additionally, our agents know of many situations in which buyers are waiving inspections or are outbid by price or by all-cash offers. Not to worry, our local experts are here to help. Here are four tips and insights.

1. Make Sure You Can View Homes Right Away

“Be ready to view homes ASAP so you don’t miss out on getting a showing appointment,” says Broker Diane Sugden.

Many homes are only on the market for a matter of days. They come and go quickly, so there is little time to debate. Make sure you are prepared to adjust your schedule as needed before you start looking at listings. Make a list of all of the neighborhoods/areas you are open to, as well as any must-haves and deal-breakers for you. This will save you time and help you view the right homes quickly with a focused approach.

2. Don’t Underestimate the Power of Local Experts

“Work with local experts! From your lender to your realtor to your closing escrow team. Professional history and work ethic are critical in crafting a strong offer where the seller can take comfort knowing their home will close on time, with no surprises,” says Susan Grosten, Managing Broker.

Undoubtedly, a real estate agent who knows the local market, the community, and the right vendors will be a tremendous help. They also have an established track record and are skilled negotiators. It’s not uncommon for experienced local agents to have worked with the agent representing the seller, which can be to your advantage. From lenders to home inspectors, home repair crews to community resources, local agents’ connections can help you in many ways.

3. Get Pre-Approved Locally

“Get yourself pre-approved with a LOCAL lender. This will serve you well as the listing broker will want to assure their sellers that the buyer can close. Most agents prefer to work with a local lender who has a proven track record and is easily accessible,” advises Broker Diane Sugden.

Getting pre-approved with a local lender will help the sellers feel great about your offer. Taking this step can make a difference, especially since they’ll want to close as quickly as possible.

4. Do Your Due Diligence

Make sure to really analyze different aspects of a property that you’re looking to buy. It shows you’re really ready to buy and can help distinguish you in a multiple offer situation. “In one instance, the sellers chose my clients because of the due diligence they did before placing their offer on the house. This pre-inspection gave my clients information on the condition and functionality of the home. Additionally, it gave the sellers confidence that my clients were serious, did their due diligence, and presented a solid offer,” says Broker Jenn Herrmann. Sellers do not want to waste any time. Anything you can do to prove that you won’t pull your offer at the last minute will give them peace of mind.

To learn more about our current market, watch our video below with stats from this year’s first quarter. For more in-depth information, read our First Quarter Market Review.

New Agent Spotlight: Ashley Mathews

We’re excited to highlight our new Broker, Ashley Mathews. Highly involved in our community, Ashley is passionate about helping people. She has a background in marketing and a range of industry experiences. Read on to find out more!

What unique professional skills do you possess that enhance your abilities as a realtor?

I started working at my mom’s travel agency at around 12 years old, which taught me organization in a transactional industry. After stints as a realtor in the fast-paced New York City market, I moved on to the marketing side of the business. I am a marketer at heart and bring the combination of my marketing expertise to my transactional knowledge of real estate, which benefits my clients.

What drew you to real estate?

Real estate has been the backdrop to my life for as long as I can remember. I love the ever-changing landscape, market conditions, and being able to impact someone’s life in such a monumental way.

How long have you lived here and what brought you here?

I have lived on Bainbridge Island for 12 years. I moved here from New York City after meeting a man from Bainbridge Island. He is now my husband of ten years.

What personality traits do you think are important in this profession?

I think it’s important to be a good listener, have the ability to roll with the punches, have a good sense of humor, and possess dedication and integrity.

What area do you serve and what do you love about it?

I serve Bainbridge Island and have a great deal of first-hand knowledge of Bainbridge’s unique neighborhoods, having lived in downtown Winslow, Fletcher Bay, the Sand Spit, and Pleasant Beach. I love its beauty and the fact that it can be whatever one desires. Sometimes I enjoy its quiet serenity. Other times, I want to enjoy one of our award-winning restaurants. There is something here for everyone.

What made you decide to work with Windermere?

My passion for service has always made me a fan of the Windermere Foundation and its work. The Windermere Brokers on Bainbridge Island have such a great reputation and I wanted to be on their team. Blue is also my favorite color.

How are you involved in the community?

I serve as a board member for the Bainbridge Island Museum of Art, and I serve as Planning Commissioner for the City of Bainbridge Island. Additionally, I serve as the Chair of the Board Development Committee for Treehouse For Kids and sit on its Board of Directors Executive Committee. For over a decade, I’ve been involved in Bainbridge Island’s vibrant equestrian community and am a member of the Bainbridge Island Saddle Club. I love the arts and have performed with the Bainbridge Chorale and on the Bainbridge Performing Arts stage in “Chicago” and “Cats”. I am also a lifetime member of the NAACP.

Is there anything else you’d like to share with us?

I have a 19-year-old daughter who inspires me every day as she navigates our new normal as a college freshman, as well as a beautiful and not so smart Doberman named Grace and a beautiful and very smart horse named Nektonia. I love to meet new Islanders so if you see me come say hi. Human connection is so important these days.

We’re so glad that Ashley Mathews has joined us. We know her local expertise and her integrity make her an excellent choice for buyers and sellers. You can connect with her on Facebook or through her website.

Home Sale Contingent Offer – Pros and Cons

There are a lot of specific terms used in real estate, and you may wonder what a home sale contingent offer is. Who does it affect and what are the advantages and disadvantages? We’re here to provide you with the information you need.

A Home Sale Contingent Offer

Offers typically come with contingencies such as a home inspection but an offer that is specifically dependent on the sale of another property is a home sale contingent offer. If there’s a home sale contingent offer, the MLS (Multiple Listings Service) will list the property as contingent. So if someone else writes up a better offer then that one is “bumpable” by someone else.

Types of Home Sale Contingencies

There are two types of home sale contingencies. One is a contingent offer and one is a pending sale contingency, which would say the other property is already under contract.

Suppose the potential homebuyer has not obtained or agreed to an offer on their own house. In that case, they may submit a home sale contingent offer. Through this contingency, the buyer effectively has “first dibs” on the house. The seller can include a “bump” clause to continue to show the property to other potential buyers. If the seller receives an offer, the first buyer has a specified amount of time to decide whether they want to move on with their contract.

If the potential homebuyer has acquired an offer and has a closing date set, they may include a pending sale contingency. Since a home is not officially “sold” until closing occurs, this protects the potential homebuyer if the deal falls through. If the house is sold, then the contract is still valid. If the deal falls through, so does the homebuyer’s offer.

Earnest money or good faith money may also be given to a seller when a buyer includes a contingency clause. This money represents the buyer’s good faith to continue with the purchase if the outlined conditions are met. Similar to a deposit, the earnest money is typically held in an escrow account until closing and then it is applied to the down payment and closing costs.

Pros and Cons of a Home Sale Contingent Offer

There are many things for the seller to consider when accepting a home sale contingent offer. If you are selling your home, you should note that there is no guarantee that the buyer’s home will sell. So it is essential to specify a timeframe for the buyer to sell their property.

On the other hand, if your property has been on the market for a while, then a home sale contingent offer may be a good option. To protect yourself as a seller, you can include a “bump” clause in the contract to obtain some leverage in the sale. You would state a specified amount of time after receiving another offer for the first buyer to decide whether they want to pursue the contract. If the buyer still wants to continue, they must remove the contingency clause to resume the contract. If the buyer does not respond in the specified amount of time, you can back out of the contract and sell to the new party.

Pros and Cons of Buying a Home with a Contingent Offer

If you are looking to buy, you might also be a home seller at the same time. If this is the case, it is crucial to understand both sides. As a buyer, a home sale contingent offer allows you to smoothly transition between houses. However, a home sale contingent offer comes with risk. You’re essentially asking the home seller to hold the house for you and risk not being able to sell their home if you’re unable to sell yours. And, when you’re looking to buy in a popular place like Bainbridge Island, multiple offer situations are common. So you’re competing with many eager buyers. Other buyers may be able to buy the home you want without having to sell their current home. Additionally, some may be willing to waive other contingencies in order to win a multiple offer situation. This does not mean that you need to do that too if that makes you uncomfortable. But it is important to consider contingencies carefully.

Bottom Line

As you can see, there are different ways to look at a home sale contingent offer. It all comes down to the offer made on the property, any time constraint on the seller to close, and the seller’s preferences. A knowledgeable, local real estate agent, will advise you, advocate on your behalf, and guide you through the process.

Everything You Need to Know about Title Insurance

Title insurance is a policy that protects you from potential problems when acquiring real estate. When you buy real estate, you’re also buying all of the assets and liabilities associated with that property. So title insurance protects you from any past title problems. Some of these problems can include forgery, fraud, liens, and prior mistakes in legal documents.

Types Of Title Insurance

There are two main types of title insurance: lender’s title insurance and owner’s title insurance. Most lenders require the borrower (homebuyer) to purchase a lender’s title insurance policy, which protects the lender. It is important to note that a lender’s policy will not cover the homebuyer from any problems with the title. To protect yourself, consider purchasing owner’s title insurance.

Owner’s title insurance will protect you, the homebuyer, from any aforementioned issues. A title search examines public records and legal documents to confirm the legal ownership of a property before a transaction takes place. It is usually performed by an attorney or a title company. Although this procedure will often identify any title issues or mistakes, sometimes mishaps occur. These mistakes can be costly down the road, so buyers often purchase title insurance to protect them and their mortgage lender from financial loss if there’s a problem with the title after the sale.

Common Claims

Some common claims filed against a title are back taxes and liens. Liens are a right to keep possession of property belonging to another person until a person’s debt is cleared. It is rare for title companies to miss a lien, but if that does happen, it can cause quite a legal headache for the homeowner. Title insurance can protect from any issues that arise due to uncleared liens.

A typical title insurance policy covers the following hazards:

- Ownership by a party other than the one who sold it to you

- Incorrect signatures on documents as well as forgery or fraud

- Mistakes in legal papers and inheritance

This type of policy also ensures that there aren’t any outstanding liens for the property. Unlike traditional insurance policies that protect you from future events, title insurance protects you from past events that may not have come up during the purchase of the property.

Title Insurance in Washington State

In Washington state, the owner’s title insurance policy is usually optional and not required by law. You can choose to buy a policy that will cover the full price that you paid for the property. The Office of the Insurance Commissioner has more information about the process of purchasing title insurance in Washington state.

It is important to note that the only time it is possible to secure the owner’s title insurance is at closing. You will not be able to purchase a policy if you discover an ownership issue after you’ve bought the property and ownership has been transferred to you.

Bottom Line

Having title insurance protects both the buyer and seller from potential risks that can lead to a considerable amount of stress down the road. It’s important to talk to your real estate agent about these details. They should be able to guide you through the process and provide additional insight. Our local Windermere agents are also here to answer any questions you may have.

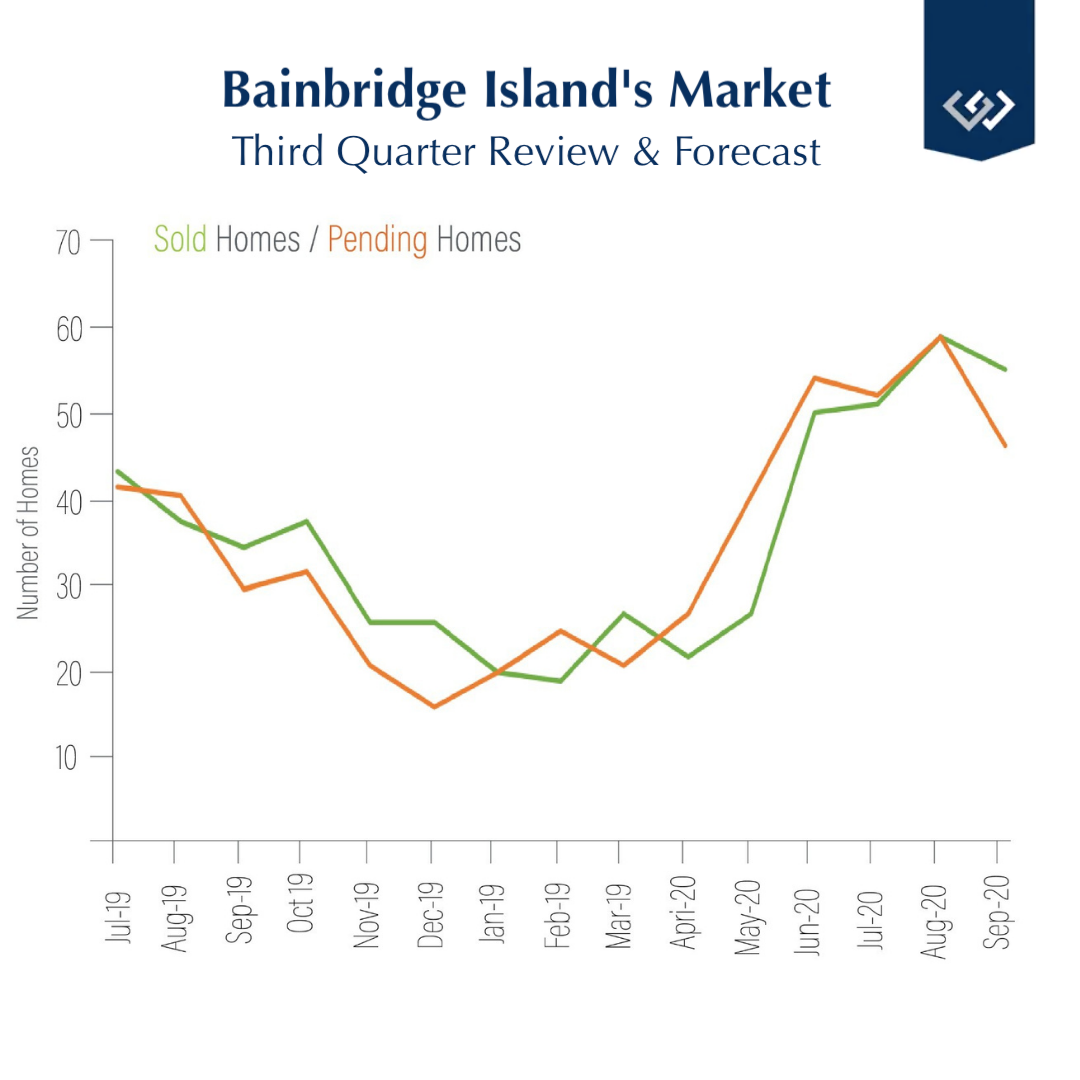

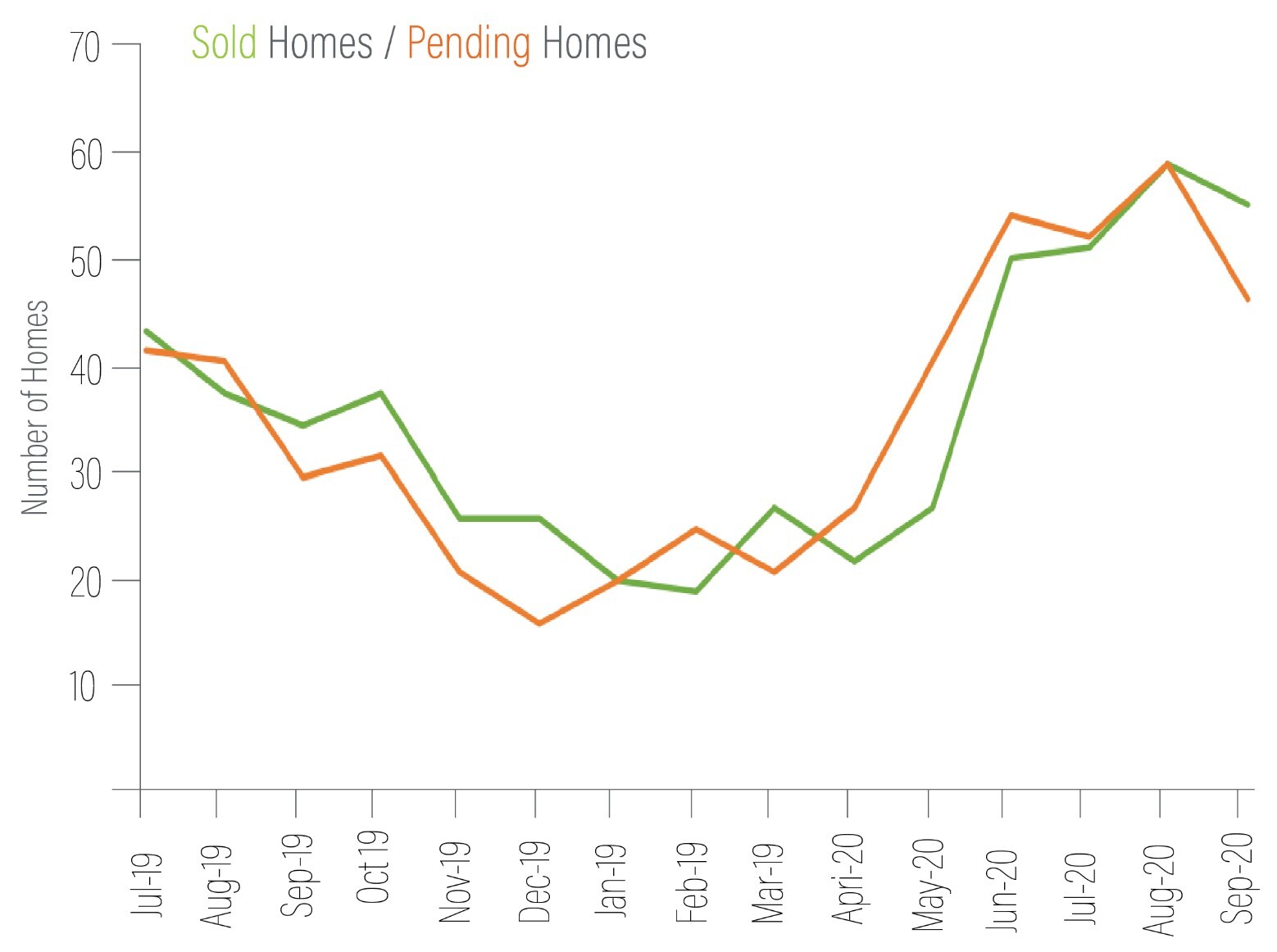

Bainbridge Island’s Market: Third Quarter Review and Forecast

Bainbridge Island’s market had an incredibly strong third quarter. We’ve compiled key stats below to provide a comprehensive review of our market, as well as insights and predictions from Windermere Real Estate’s Chief Economist, Matthew Gardner.

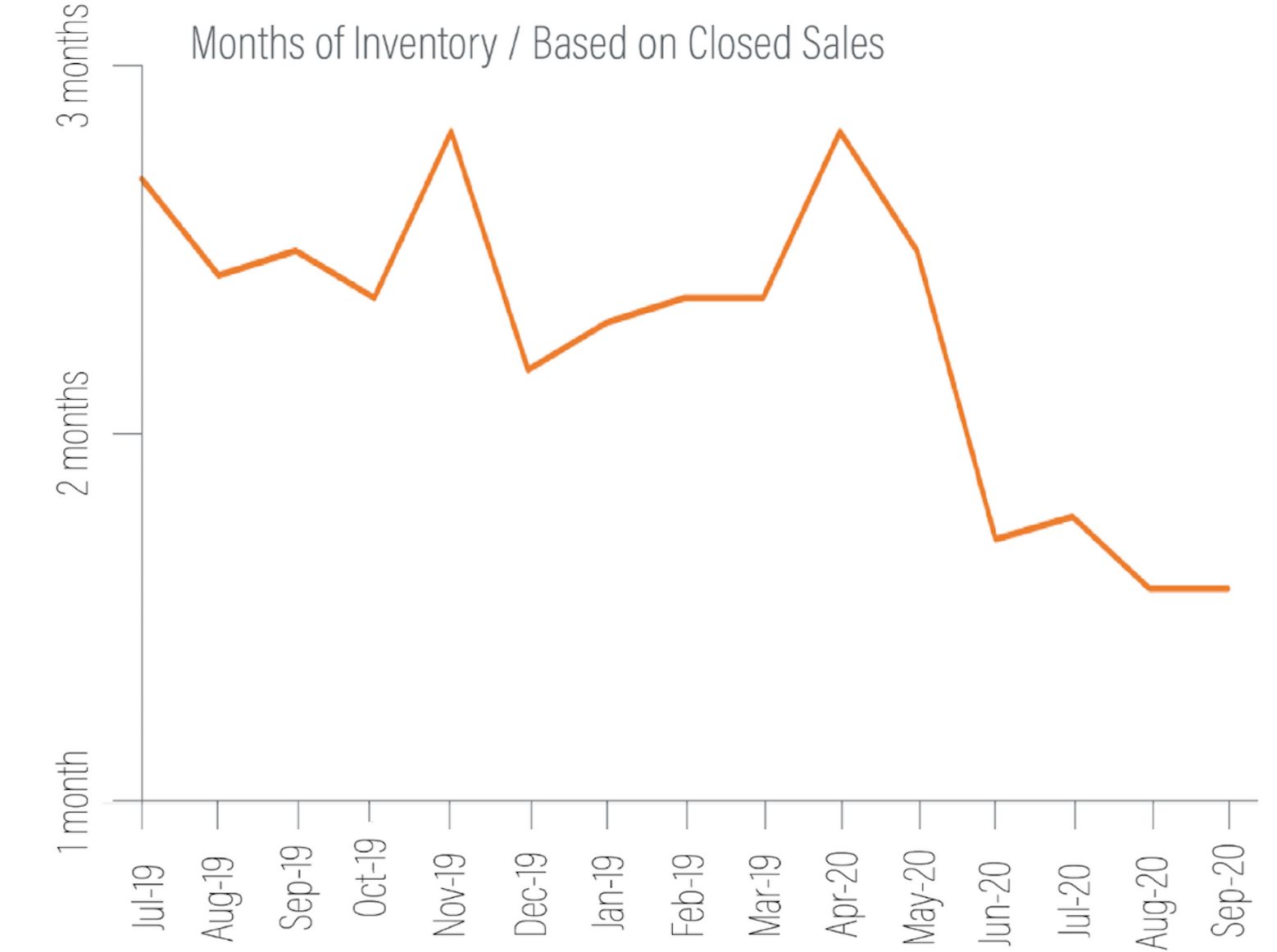

Our Strong Seller’s Market

It’s a hot seller’s market here on Bainbridge Island. Inventory remains low and demand is still high. In our third quarter, closed sales were up 43.6% year-over-year. Buyers should be aware that multiple offer situations are very common. Our Brokers have seen a significant increase in all-cash offers. In September alone (when the market typically starts to cool down), 37% of all Bainbridge Island residential sales were from all-cash buyers.

Market Predictions

Although mortgage rates remain historically low and demand is high, our Chief Economist, Matthew Gardner, has some concerns about how this may impact real estate down the road. “We may be heading towards a period where we see houses turn over at a far slower pace as we stay in our homes for longer than ever…this could be a problem as it leads to persistently low levels of inventory for sale, which itself could lead to prices continuing to rise at above-average rates and that would further hit affordability.” As for mortgage rates, Gardner does not expect them to rise significantly any time soon. However, he says, “We should all be aware that there could be consequences to very low rates”.

Western Washington Review

Let’s zoom out a bit and look at our area. Below are highlights from The Western Washington Gardner Report provided by Windermere Real Estate’s Chief Economist, Matthew Gardner.

WESTERN WASHINGTON HOME SALES

- Total Sales: 11.6% increase from Q3/2019, and 45.9% higher than Q2/2020

- Homes for Sale: 41.7% lower than Q3/2019, but up 1.6% from Q2/2020

- Pending Sales: up 29% from Q2/2020

WESTERN WASHINGTON HOME PRICES

- Average: $611,793 (up 17.1% from Q3/2019). Low mortgage rates and limited inventory are clearly pushing prices up.

- Prices will continue to increase as long as mortgage rates and inventory levels stay low. If this continues to be the case, affordability issues will become more apparent in many markets.

DAYS ON MARKET, WESTERN WASHINGTON

- Average: 36 days (an average of 4 fewer days than in Q2/2020 and 2 fewer days than in Q3/2019)

- Kitsap County’s average days on market: 20

Conclusion

In Gardner’s Western Washington Report, he states that, although we have a strong seller’s market that is very buoyant, he’s “starting to see affordability issues increase in many areas—not just in the central Puget Sound region—and this is concerning. Perhaps the winter will act to cool the market, but something is telling me we shouldn’t count on it.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link