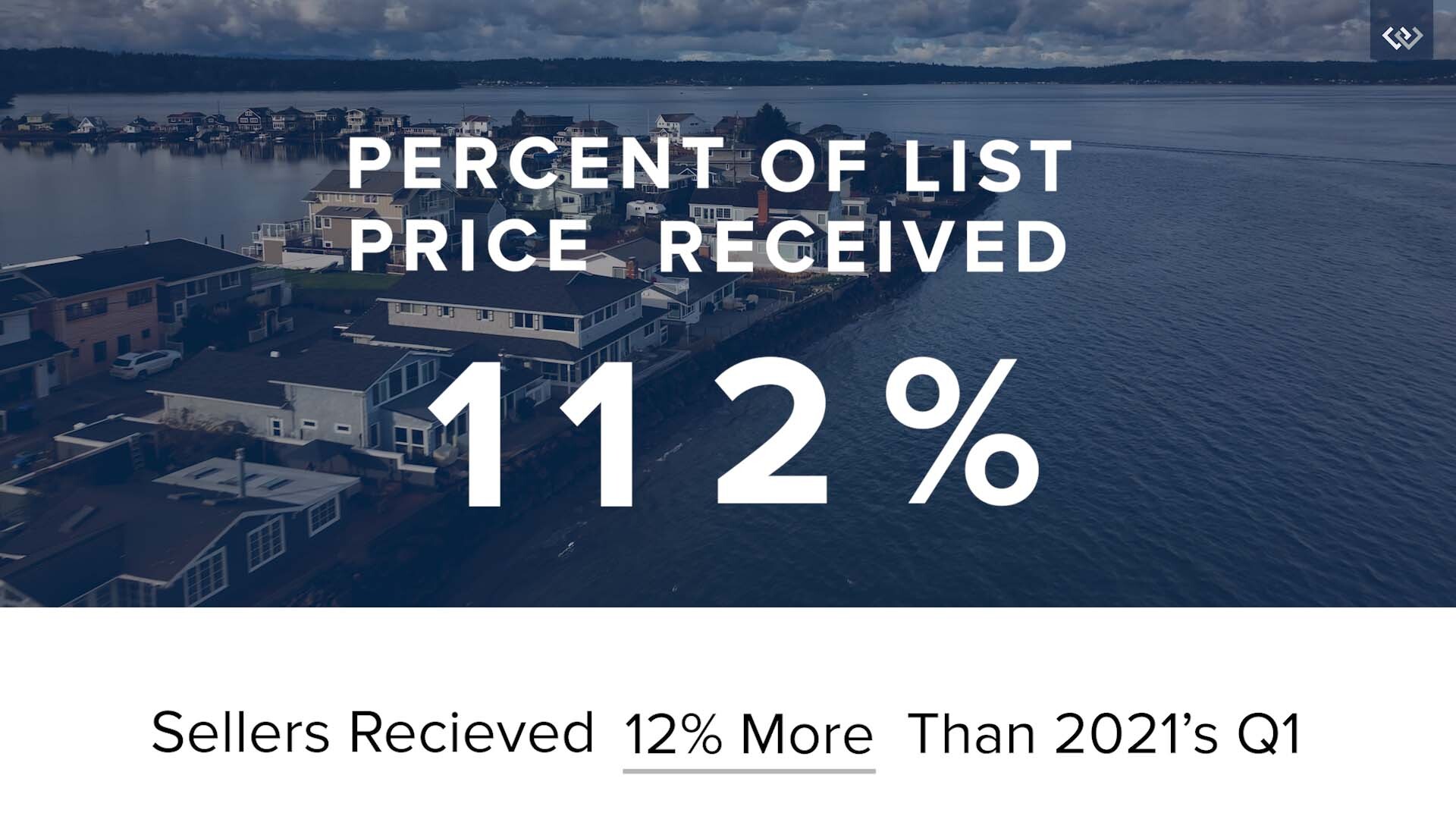

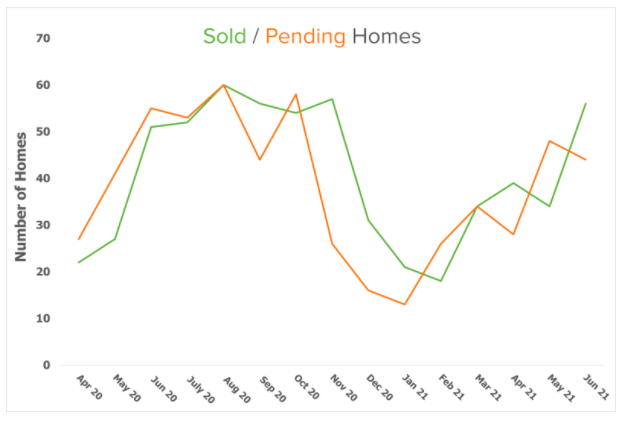

Bainbridge’s Market: First Quarter, 2022

Bainbridge’s market picked up in the first quarter of 2022. As was the case in 2021, it’s a seller’s market due to low inventory and high demand. Homes are still selling above the asking price and we’re seeing multiple offer situations and many all-cash offers. We’ve compiled key highlights from last quarter to keep you in the know about our local market.

Sold and Pending Homes

In the last five quarters outlined in the graph, 2022’s first quarter is rising like the first quarter of 2021. This follows the usual real estate market trend and we expect to see another hot market this summer. There’s also a significant lack of inventory and there are many eager buyers, driving prices up and heavily influencing our seller’s market.

Bainbridge’s Market Still Favors Sellers

Everyone is feeling the fatigue of low supply, which persisted in the first quarter of 2022. But we expect the market to warm up as we head toward our busy summer season. More real estate activity lies ahead, and if you’re thinking of selling, it’s a great time to do so. If you’re looking to buy, be prepared for the competition and know that having a local real estate agent at your side is extremely beneficial.

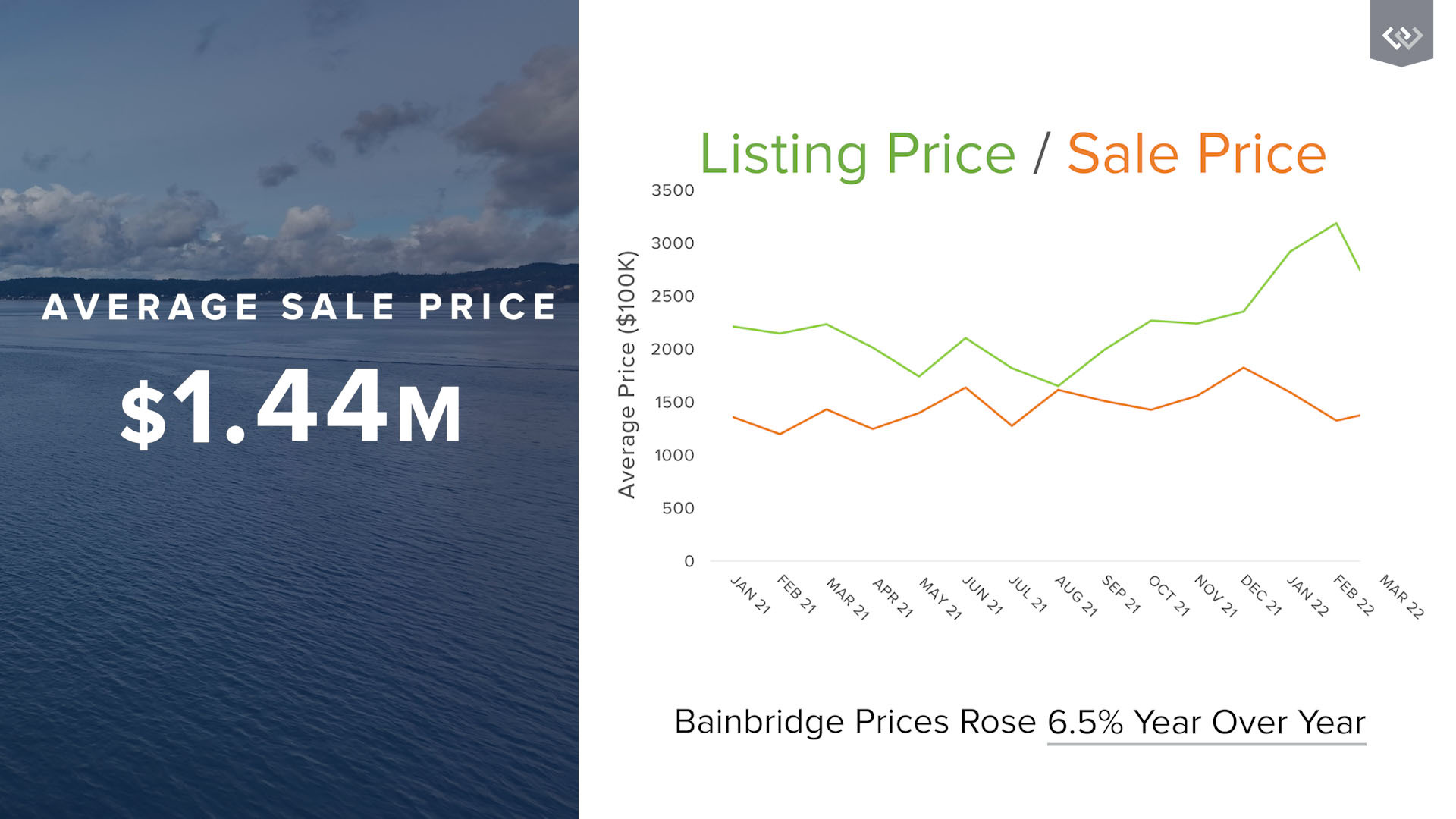

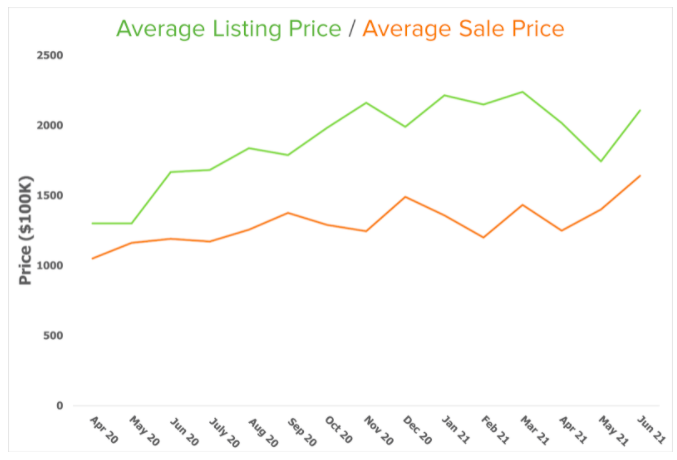

Listing Price vs. Sale Price

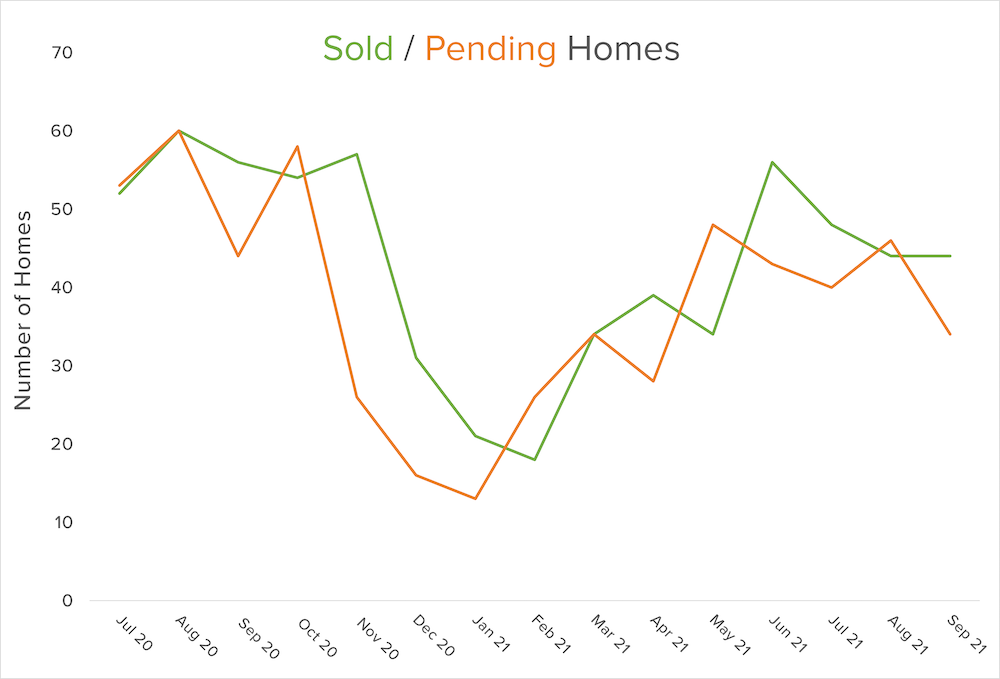

As a result of low supply, average prices rose 6.5% when compared to this time last year. They are expected to continue to rise as Bainbridge’s buyers meet the pricing demands of sellers. And, the average sale price on Bainbridge Island is almost $1.5 million.

Insights from Our Chief Economist

Matthew Gardner, Windermere’s Chief Economist, shared his Top 10 Predictions for 2022 in one of his recent Monday with Matthew videos. Here’s what Gardner predicts for 2022:

- Prices will continue to rise, though the pace of appreciation will slow. Gardner thinks it will be about 6% in 2022 versus the massive 16% rise of 2021.

- Spring will be busier than expected. This will increase buyer demand, as buyers get more clarity in their new hybrid model combining remote and office work.

- The rise of the suburbs will also result from this work hybrid model. Many buyers are moving within the same area they already lived in.

- New construction jumps since the cost to build has come down.

- Zoning issues will be addressed.

- Climate change will impact where buyers live. People will focus more on how safe a location is in relation to natural disasters.

- Urban markets will bounce back after the demand drop from Covid.

- A resurgence in foreign investors will return since the travel bans were lifted last November. The demand will rise as long as our borders remain open.

- First-time buyers will be an even bigger factor in 2022. This year, 4.8 million millennials will turn 30, the median age of American first-time buyers. Additionally, first-time buyers will be looking for cheaper markets.

- Forbearance will come to an end and that will be okay. It was well thought out, and as Gardner says, “as of recording this video, there are now fewer than 900,000 owners still in the program.” Hopefully, this continues to drop.

For additional information, check out Matthew Gardener’s Market Update by region.

Fourth Quarter Market Review for Bainbridge Island

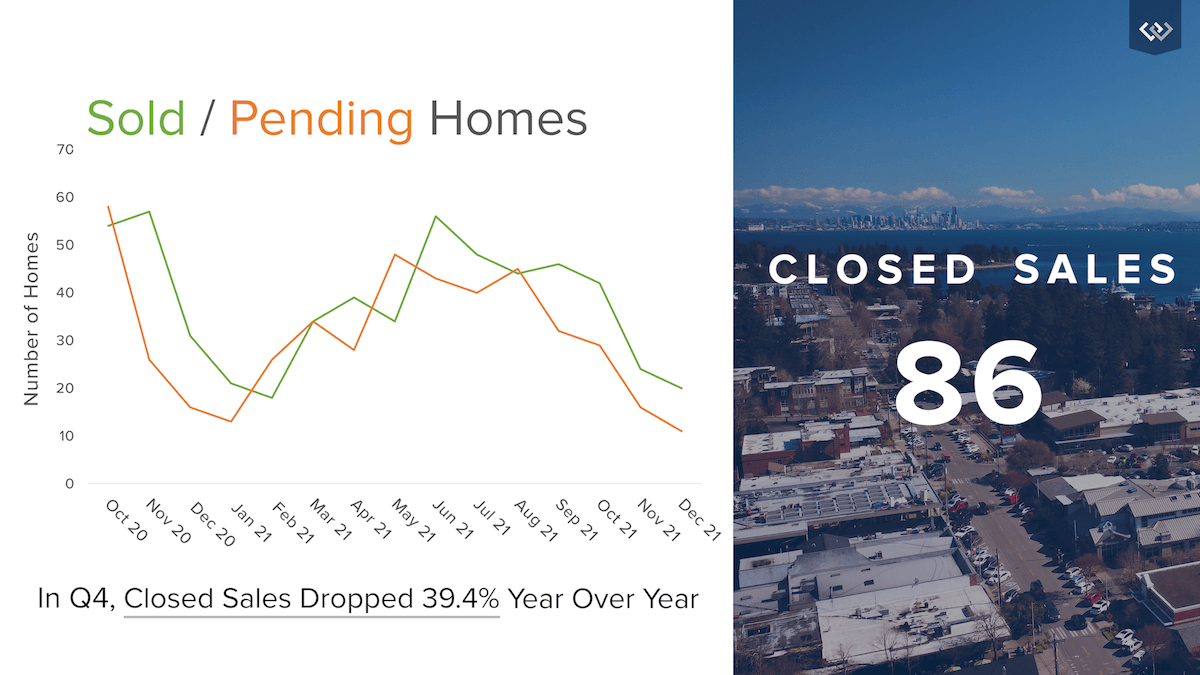

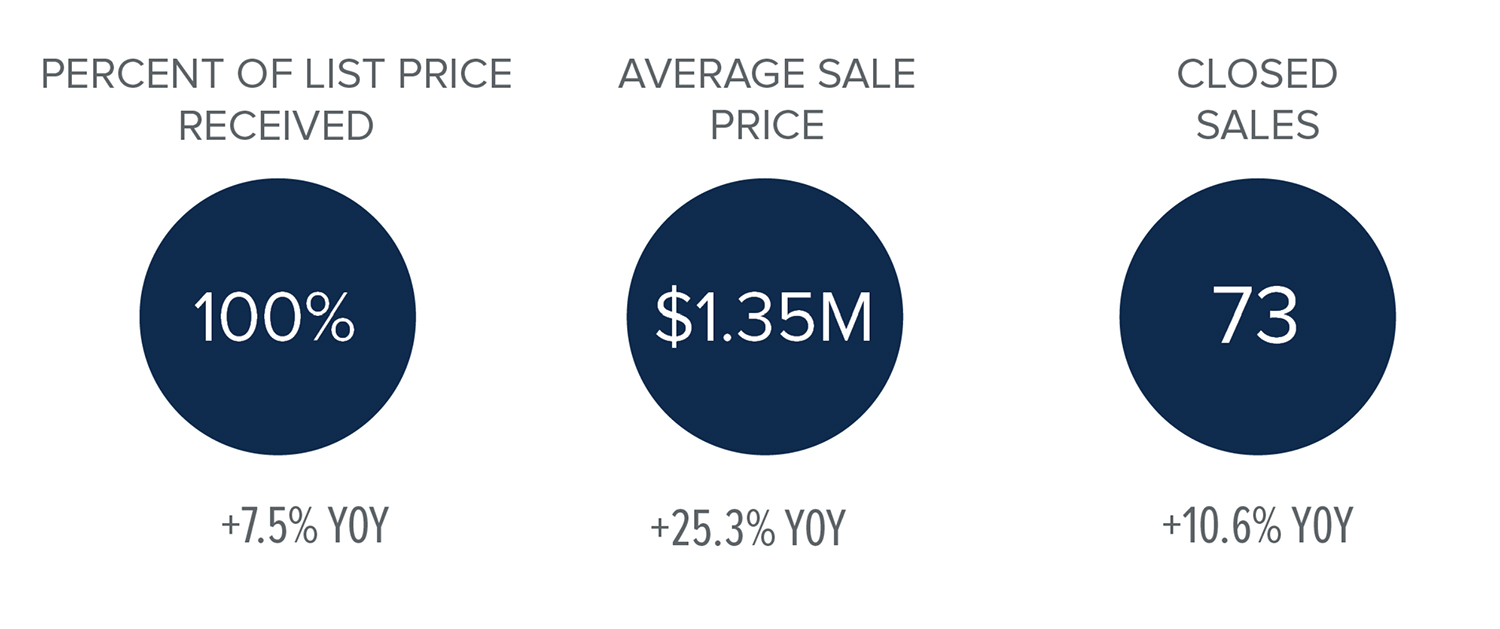

Bainbridge’s real estate market slowed down for the holidays during our fourth quarter. The market still favors sellers due to low inventory, and homes are still selling above the asking price. We’ve compiled key highlights to keep you in the know about our local market.

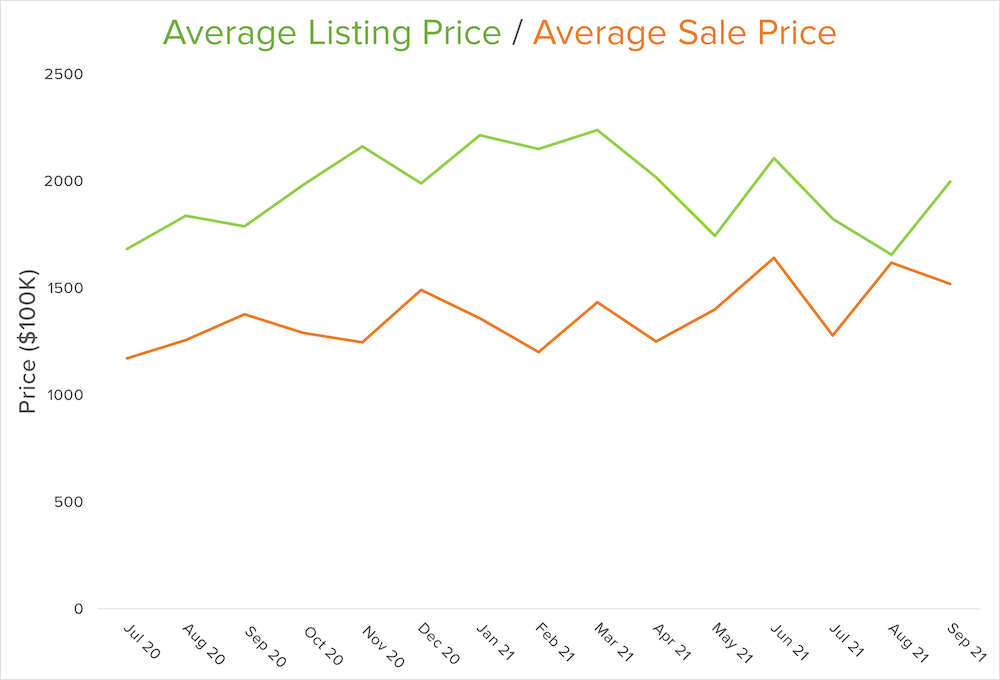

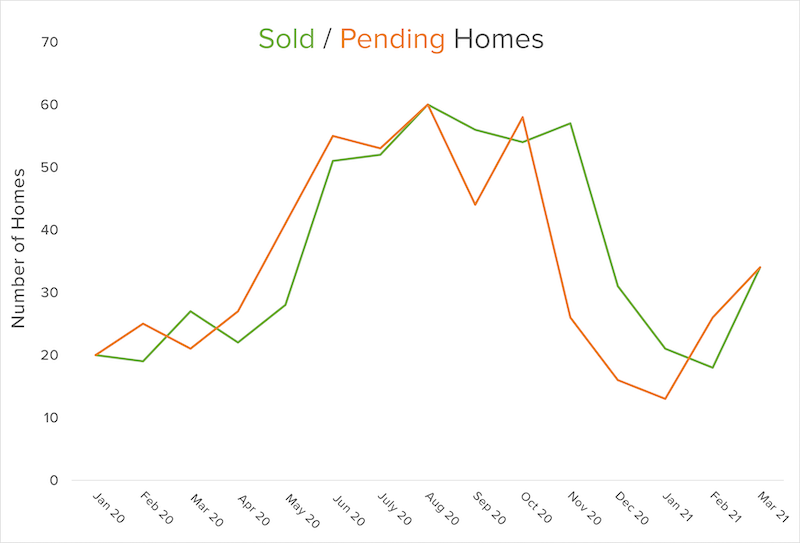

News on Sold and Pending Homes

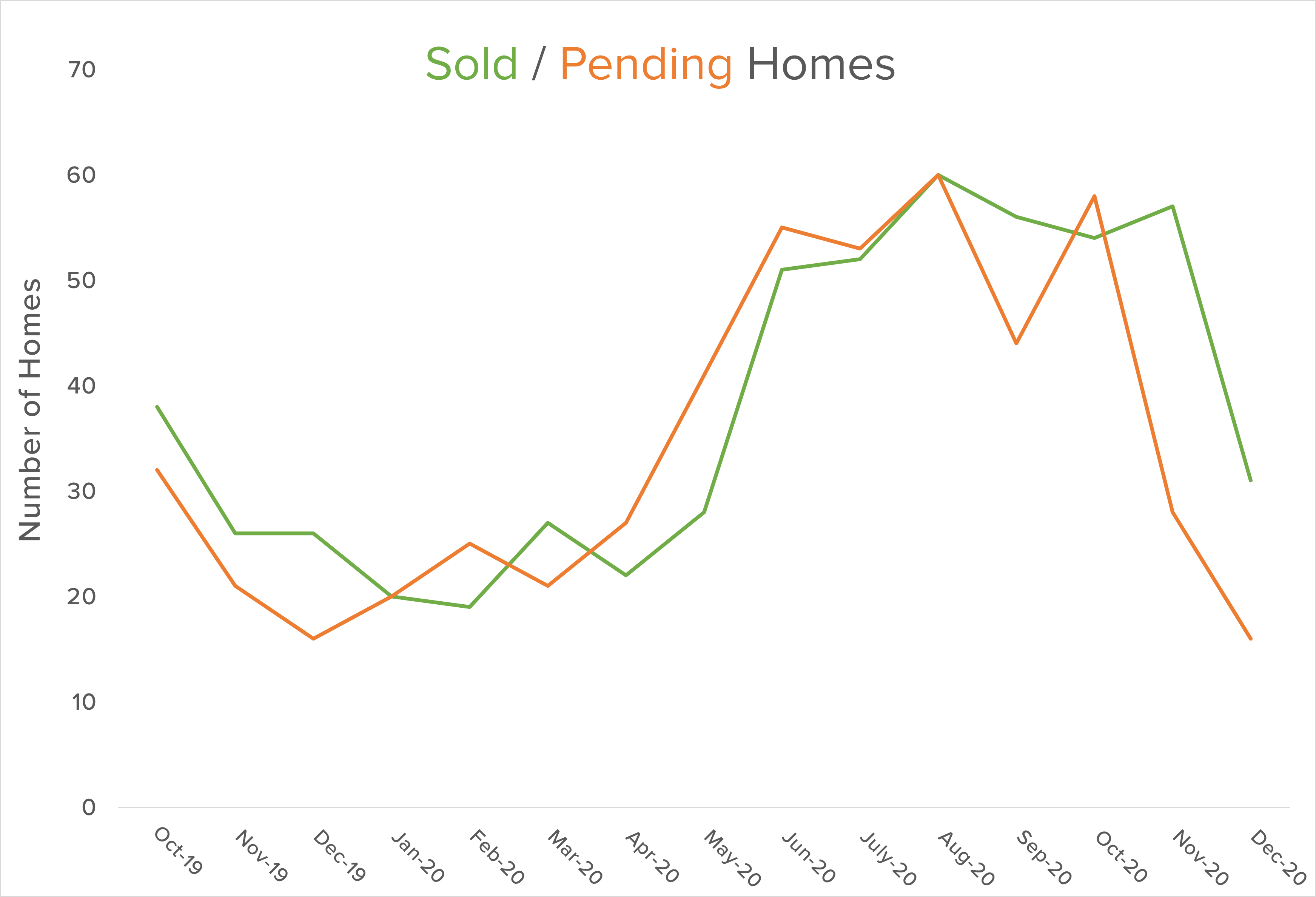

In the last five quarters outlined in the graph, 2021’s real estate market started with the usual growth trend into the summer. Now, we’re seeing the seasonal downswing during colder months. However, home prices are still increasing due to demand and sold homes still outpace pending listings. The result is a strong seller’s market. In the 4th quarter of 2021, we had 86 closed sales, which is a 39.4% decrease, year over year.

Still a Strong Seller’s Market

Bainbridge Island real estate demand was at a record high in the fourth quarter of 2021. With the new era of remote work, many Seattle homebuyers are seeking the quaint island feel that Bainbridge offers. If you want to learn more about Bainbridge Island, check out our free digital guide. If you’re interested in buying or selling, our local experts are here to help.

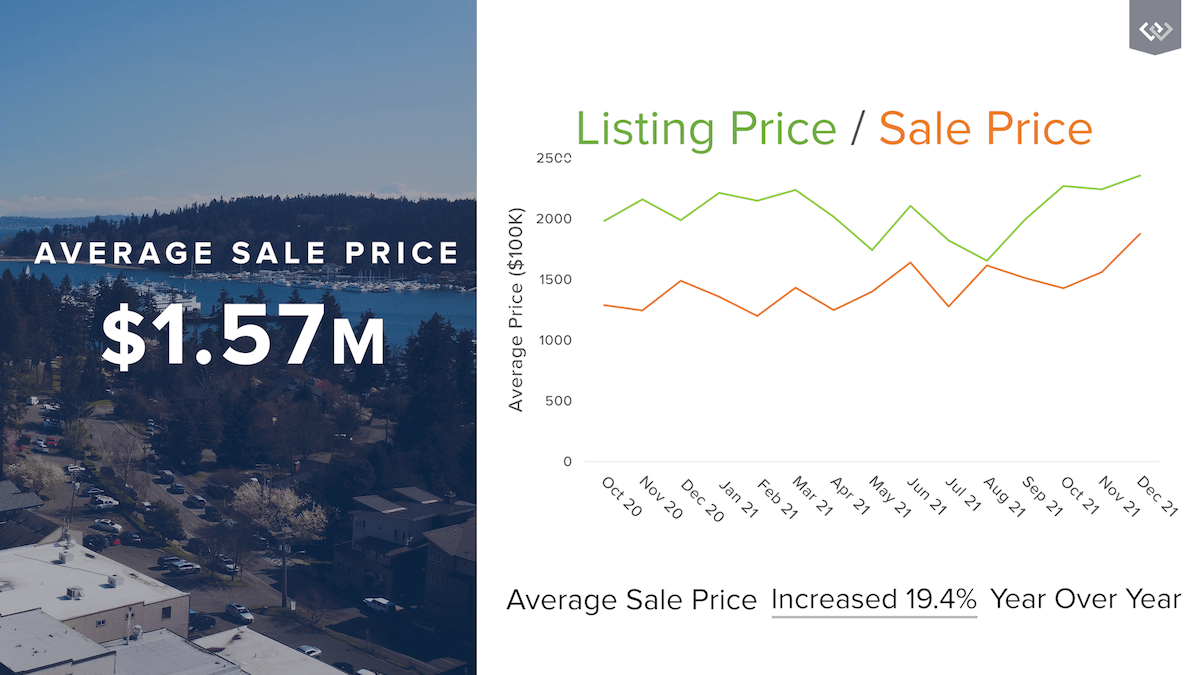

Listing Price vs. Sale Price

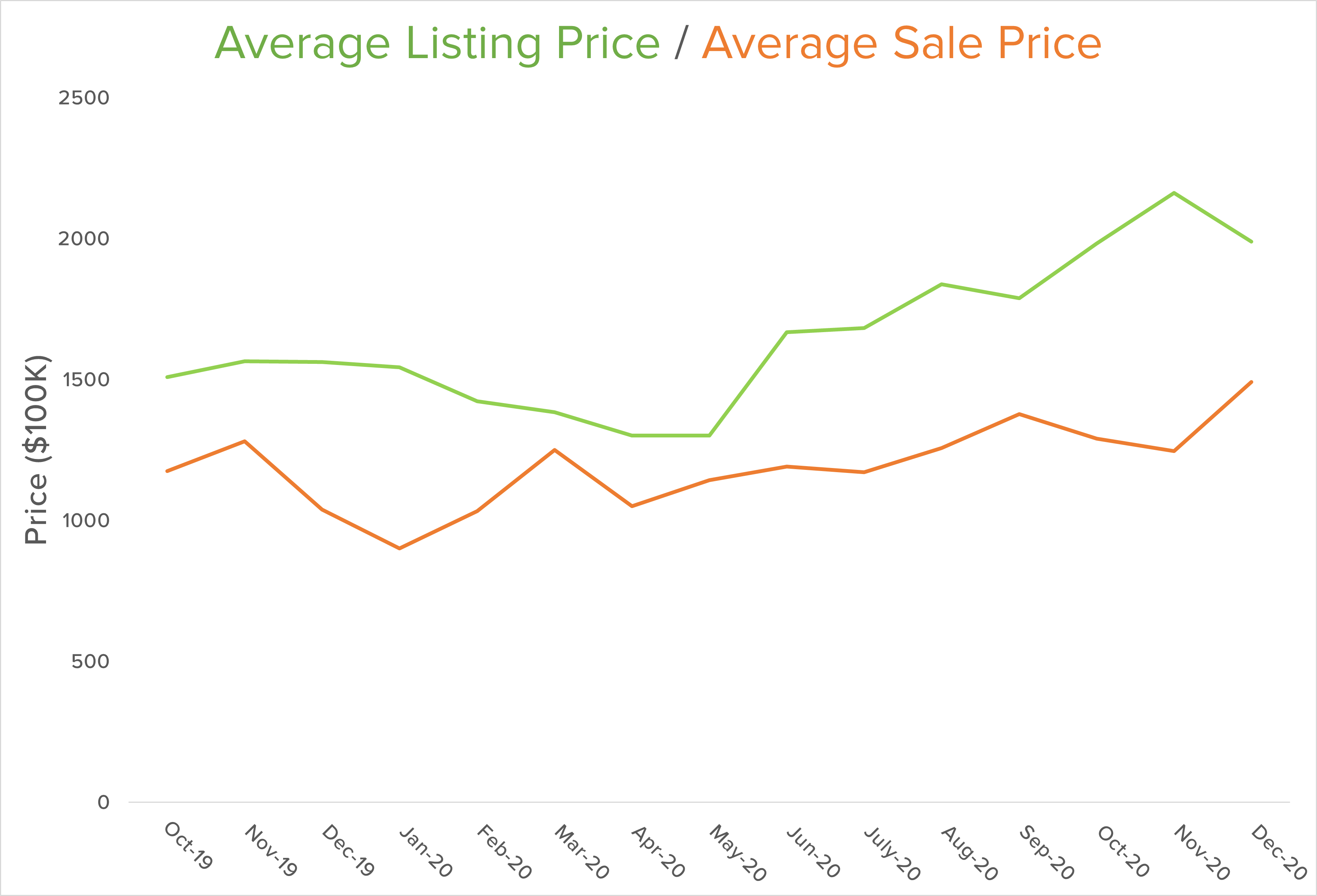

Although buyers continue to meet the competitive Bainbridge pricing, there just aren’t enough homes available right now. As you can see in the graph above, the averages of listing and sale prices are starting to converge as demand stretches the cost of housing even further in favor of sellers. In our 4th quarter, we saw a 19.4% increase in the average sale price on Bainbridge Island, putting it at $1.57 million.

Insights from Our Chief Economist

In his most recent Monday with Matthew, Windermere’s Chief Economist, Matthew Gardner, shares his market forecast for the coming year: “If everything goes according to my plan, you should expect to see the housing market start to move towards some sort of balance next year, but I am afraid that it will still remain out of equilibrium until at least 2023.” Gardner reminds us that the transition back to a balanced market will be a gradual shift.

While Matthew ensures us that he “doesn’t see a housing bubble forming,” he goes on to say “it would be silly to say that there aren’t any issues in the housing market that concern me because there are and the biggest of which is housing affordability.” There is definite cause for concern among the millennial generation as they start “thinking about settling down and, possibly, having children” Gardner explains. “I wonder how hard it will be for many of them to be able to afford to buy their first home.” Millennials are currently the largest slice of the generational real estate market, so it will be interesting to see where affordability and demand intersect.

Overall, Gardner concludes with a high-level market analysis: “demand for ownership housing remains remarkably buoyant and, in fact, it is quite likely that demand may actually increase with the work from home paradigm that will start to gain momentum next year.” With dependable demand, real estate continues to be an excellent investment.

Third Quarter Market Review for Bainbridge Island

Bainbridge Island’s real estate market remains a strong seller’s market. In our third quarter, we continued to see homes sell above the asking price. We also saw a similar increase in average sale price when compared to this time last year. We’ve compiled key highlights to keep you in the know about our local market.

Bainbridge’s Competitive Market

Bainbridge Island continues to get more competitive for buyers in this third quarter. Many home buyers want to live near Seattle while enjoying beautiful Bainbridge, and remote work trends have increased demand. However, the volume of homes on the market decreased year-over-year, making our seller’s market that much stronger. If you’re looking to buy, our Brokers can help guide you through this competitive market. They know this market extremely well, they know the nuances of Bainbridge’s neighborhoods, and they have excellent track records.

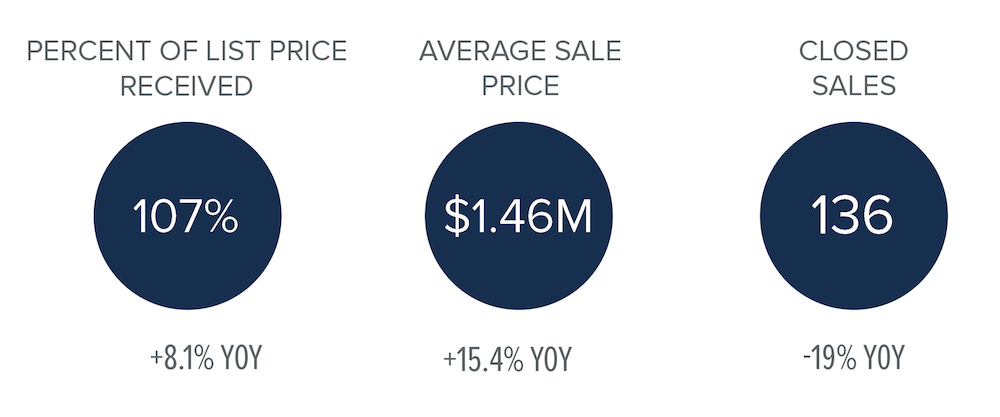

Market Data

In the last five quarters outlined in the graph below, the long-standing growth trend in sales volume is finally slowing. Yet home prices are still growing and sold homes still outpace pending listings as a result of the increased economic demand. As the season slows and inventory wanes, prices may level – effectively balancing out the market between buyers and sellers. Or, at least they will start to shift toward a more balanced market.

With our lower supply, we continue to see even higher prices. While many buyers are willing to meet the demands of Bainbridge Island’s pricing, there just aren’t enough homes on the market right now. As you can see below, the averages of listing and sale prices are starting to converge as demand stretches the costs of housing even further in favor of sellers.

Home Purchase Sentiment Index: Insights from Matthew Gardner

In his most recent Monday with Matthew video, our Chief Economist delivered a comprehensive analysis of the most recent Home Purchase Sentiment Index figures put out by Fannie Mae. The data comes from a survey containing approximately 100 questions on housing-related topics. Fannie Mae collected 1,000 consumer responses from across the country. As Matthew Gardner says, “It’s the only national, monthly survey that’s focused primarily on housing.”

The survey shows that many Americans continue to think it is not a good time to buy because of the low supply and rapidly rising prices. However, many feel it is a good time to sell as consumers predict home prices and mortgage rates will go down. As Gardner explains, “most consumers continue to report that it’s a good time to sell a home, but a bad time to buy. They most frequently cite high home prices and a lack of supply as their primary rationale…However, the good time to buy component did tick up for the first time since March.” While this is a recipe to shift towards a buyer’s market, we’ll see how things unfold in the coming months.

Gardner sums it up nicely: “The takeaways for me so far are that consumers tempered both their recent pessimism about home buying conditions and their upward expectations of home price growth.” So again, we are seeing the potential for a shift toward a more balanced market.

Second Quarter Market Review for Bainbridge Island

Bainbridge’s real estate market exceeded expectations in our second quarter. That’s even compared to last year’s similarly strong performance. We’ve compiled key highlights to keep you in the know about our local market.

Our Strong Seller’s Market

Bainbridge Island is still an increasingly competitive market, and we just had a strong second quarter. Since Bainbridge is so close to Seattle and retains its island beauty, it continues to attract buyers moving away from bigger cities as the way we work continues to trend toward remote work. There are still many more highly motivated buyers than sellers. Inventory remains low and demand remains high. Our Brokers can help navigate this competitive market. We’ve seen continued situations where buyers are outbid either by price or by an all-cash offer. Having a local expert as your guide can help you achieve success.

In the last five quarters outlined in the graph below, the continued growth trend in sales volume for the second quarter of 2021 is even higher than 2020’s second quarter. That was during the Covid lockdowns, which prompted a surge in home buying in places outside major cities – like Bainbridge Island and beyond.

Average Prices

With our lower supply, we continue to see even higher prices. And, still, many buyers are showing that they are willing to meet the demands of Bainbridge’s pricing. As you can see below, the listing and sale prices both continue to rise. Sellers continue to benefit from our inventory shortage.

Market Insights from Matthew Gardner

In his most recent Monday with Matthew, our Chief Economist, Matthew Gardner, begins with the staggering fact that “prices have risen almost three-fold, as the cost to finance has dropped by 72%.” If the number sounds too good (or bad) to be true, that’s because it is. To get an accurate picture, you also have to consider inflation. Gardner points out that “just like other goods and services, the price of a house today is not directly comparable to the price of that same house 30 years ago”. That’s due to the influence of inflation in the long run. When you adjust for inflation, the rise in housing prices becomes less drastic. Without adjusting for inflation, “prices have risen by 268%.” But when you adjust for inflation, the “real prices have increased by 83.6%.” Therefore, “the increase is significantly lower than most people are talking about today.” This should come as welcome news to discouraged first-time home buyers.

Gardner then compares mortgage payments. Although, without adjusting for inflation, “mortgage payments have increased by 74.3%,” the inflation-adjusted “real payments are 10.7% lower!”. Of course, there are other monthly payments associated with homeownership like property taxes. They do not change with market fluctuations. But this still indicates “that prices have been able to rise so significantly because mortgage rates have dropped.” Additionally, home prices adjusted for inflation really haven’t skyrocketed, though many seem to think so. Again, this is great news for buyers.

There are some caveats, though. Gardner clarifies that “there are some markets across the country where the picture isn’t quite as rosy. In these places, prices have risen significantly more than the national average.” The Seattle metropolitan subunit, which extends around our local area, is one of these places. This is largely from the increasing affluence in relation to the tech boom.

Not a Housing Bubble

Gardner says the bottom line is “there are quantifiable reasons to believe that we are not in a national housing bubble today. But some markets will experience a significant slowdown in price growth given where prices are today in concert with the spectre of rising mortgage rates.” Ultimately, it’s still a strong seller’s market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices and mortgage rates continue to climb.

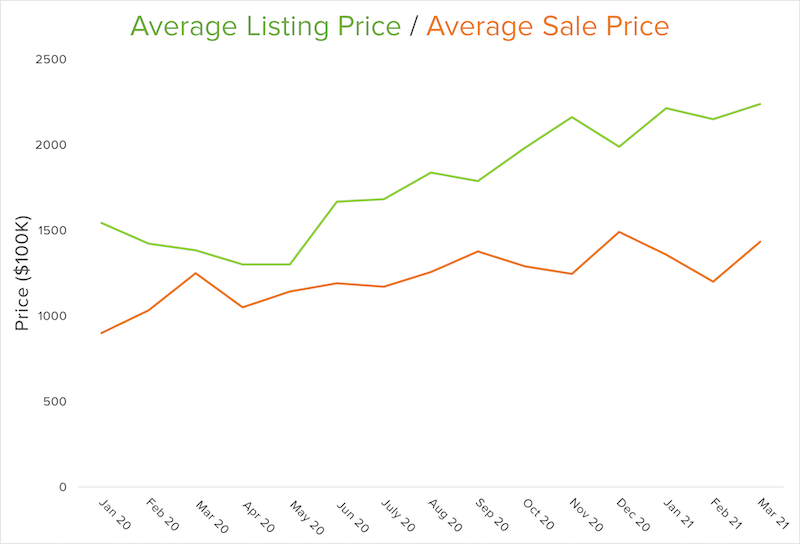

First Quarter Market Review for Bainbridge Island

Bainbridge’s real estate market is picking up after the winter slowdown. We’ve compiled key highlights from our first quarter to keep you in the know about our local island market.

Our Strong Seller’s Market

Bainbridge Island has a very competitive market right now, and we just had a strong first quarter. With Bainbridge’s quaint island feel and its proximity to Seattle, it’s very appealing to people moving away from bigger cities as COVID-19 changes the way we work. There are still many eager buyers outnumbering sellers as inventory remains low and demand remains high. Our Brokers can help navigate this competitive market. We’ve seen many situations where buyers are outbid either by price or by an all-cash offer. Having a local expert as your guide can help you achieve success.

In the last five quarters outlined in the graph below, you can see that a similar growth trend in volume is repeated when comparing 2020’s first quarter to 2021’s first quarter. We saw quite a spike this past quarter from January to March. Get ready for the market to continue to heat up as we move from spring to summer.

With our lower supply, we’re seeing even higher prices. And, many buyers are willing to meet the demands of Bainbridge’s pricing. As you can see below, the listing and sale prices both continue to rise as sellers benefit from our inventory shortage. We’re beginning to see an affordability ceiling in which some people looking to buy on Bainbridge Island aren’t able to do so.

Affordability Issues and Market Insights

Matthew Gardner, Windermere’s Chief Economist, continues to track this affordability ceiling in his most recent Housing and Economic Update: “If the pace of home price growth continues, many households will start to be priced out” of what people can actually afford. As Gardner points out, we need more supply, and we need home prices to drop to alleviate this market strain.

Unfortunately, that might not happen fast enough for many hopeful homebuyers to make their dream a reality. Gardner reminds us that the cost of materials, recent storms, and the current housing market prices have all added to the cost of building new homes. This, in turn, will add to the listing price.

Additionally, Gardner points out that mortgage rates have risen after “a jump in bond yields has led rates to spike” as the country re-opens and economic activity increases. The resulting potential inflation causes the 10-year treasury interest rates to rise in hopes of attracting more buyers. However, it is still far below standard rates and shouldn’t be a concern for buyers right now.

Ultimately, it’s still a strong Seller’s Market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices continue to climb.

Fourth Quarter Review and 2021 Forecast for Bainbridge Island

Bainbridge Island’s real estate market finished 2020 with a strong fourth quarter. We’ve compiled key stats below to provide a comprehensive review of our local market, as well as insights and a 2021 market forecast from Windermere Real Estate’s Chief Economist, Matthew Gardner.

Our Strong Seller’s Market

It’s still a strong seller’s market here on Bainbridge Island. Inventory remains low while demand is high. Buyers should be aware that the market is in a seasonal slowdown, but not as slow as expected, given COVID-19. There are still many buyers looking to move away from Seattle, but still remain close by; inventory remains low, giving the advantage to sellers. Our Brokers have seen an increase in situations where some buyers are outbid either by price or an all-cash offer.

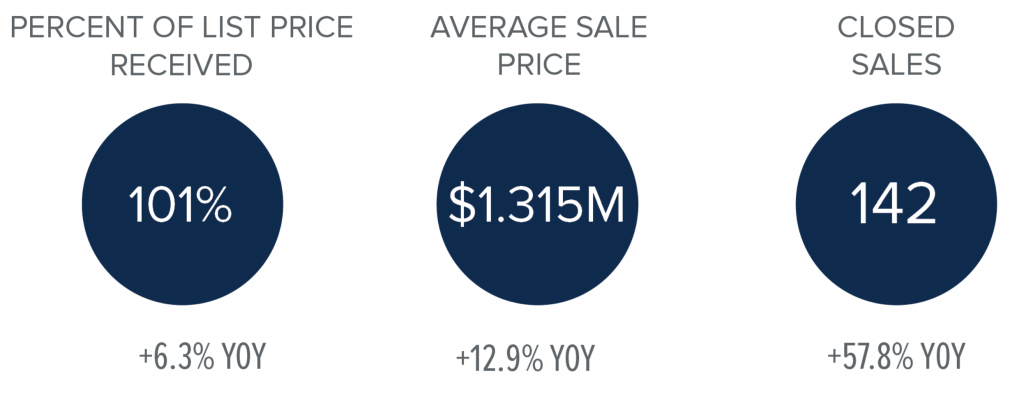

In 2020’s fourth quarter, the average sale price on Bainbridge Island was up 12.9% year-over-year at a very strong $1.315M. Sale prices continue to hover close to listing prices, indicating strong demand.

2021 Market Forecast

In his final Monday with Matthew video of 2020, our Chief Economist, Matthew Gardner, shared his 2021 market forecast. He’s optimistic and for some good reasons.

First off, Gardner expects mortgage rates will not rise significantly on a local level, nor will they vary significantly throughout different regions across the U.S. Since mortgage rates are heavily tied to 10-year treasury maturity rates/yields, rates shouldn’t rise significantly until the entire market recovers from the COVID-19 slowdown. Another great sign is that Gardner expects home sales will grow, from 5.55% in 2020 to 5.93% in 2021. That’s “to a level we haven’t seen since 2006,” Gardner explains. With the continuation of historically low mortgage rates and the consistent increase of home values, 2021 looks bright.

“No! There isn’t a housing bubble forming. But price growth will slow & sellers may feel like it’s a collapse … it isn’t collapsing, it’s just normalizing.”

Matthew reminds us that there are pitfalls to be wary of in this strong market. First and foremost: “we need more inventory.” With the shuffling to new homes, and the huge wave of “first-time buyers [that] will continue to be a major player in the housing market,” many are making moves in a flood that will not persist. Buying during the pandemic will slowly settle. People are expected to stay in their homes longer, especially homeowners who have chosen to refinance. House values will rise due to the lack of supply, and that may price out many buyers who want to purchase in our area.

Western Washington’s Market Report

WESTERN WASHINGTON HOME SALES

- Total Sales: 26.6% increase from Q4/2019, but 8.3% lower than Q3/2020

- Homes for Sale: 37.3% lower than Q4/2019, and 31.2% lower than Q3/2020

- Pending Sales: up 25% from Q4/2019, but 31% lower than Q3/2020

- Average: $617,475 (up 17.4% from Q4/2019). This continues the trend of above-average appreciation of home values.

- Interestingly, prices between Q3 and Q4 of 2020 only rose by 1%. Is there a price ceiling we’re reaching?

- Mortgage rates will stay competitive as the market continues to charge toward a price ceiling and potential affordability issues.

- Average: 31 Days (16 days less than Q4 just one year ago)

- In Kitsap County, average days on market: 17

Conclusion

2021 will continue the trend of working from home, which keeps demand high. This, in turn, will drive sales growth, while affordability barriers will balance our current runaway appreciation for home values.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link